GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Automated bookkeeping is revolutionizing the accounting world in the UK. Conventional manual processing of receipts, invoices, and ledgers is slow and prone to errors due to the human element. For many small and medium-sized enterprises (SMEs), outdated processes are not only costly but also pose a threat to compliance and consume a significant amount of time that could be better utilized for promoting growth and expansion.

Automation transforms this. Artificial intelligence gives businesses access to accuracy, speed, and insights that only large firms with full-time finance departments could previously access. With the Making Tax Digital (MTD) initiative led by HMRC requiring businesses to maintain digital records, automation is no longer optional but an absolute necessity.

This blog will define what automated bookkeeping is, explain why businesses are rapidly adopting it, outline the main advantages it offers, highlight the best options that have emerged in 2025, and discuss the future of bookkeeping as more tasks are automated.

An automated bookkeeping system, also known as a computerized accounting system, utilizes technology to record, categorize, and reconcile transactions without requiring direct human intervention. Rather than manually inputting every sale, expense, or bank transaction, automation enables the software to do so in real-time.

For example, a retail shop in London that accepts online payments with cards is no longer required to track daily revenue manually. The software extracts payment data from the bank feed and, using defined VAT rules and transaction types, automatically classifies and updates the cash flow report. Expenses, invoicing and payroll can also be run in the background.

Automation transforms a highly manual, time-consuming process in traditional bookkeeping into a digital, more accurate one, as it interacts with various financial applications, including bank accounts, HMRC digital systems, point-of-sale software, and payroll platforms, to ensure every aspect of analysis is accurate and compliant.

This migration from manual accounting to automated accounting is not just a fad- it is being necessitated by structural as well as regulatory changes that have been taking place in the business environment.

The HMRC Making Tax Digital scheme requires businesses to maintain digital bookkeeping records and file VAT returns online. Manual bookkeeping systems complicate the compliance process, whereas automated accounting software provides a direct link to HMRC, ensuring all submissions are error-free and accurate.

SMEs are wasting hundreds of hours each week compiling receipts, balancing transactions, and checking VAT calculations. These mundane tasks consume resources that the business could utilize for expansion. This load is alleviated by automation, clearing space to make strategic choices.

Inflation, supply chain shocks, and increased wage demands are all taking a toll on small businesses in the United Kingdom. It is essential to optimize the financial overheads. Automation also means that it does not require a huge finance department, thus reducing payroll costs and increasing production.

Business executives cannot afford to rely on outdated monthly or quarterly reports. Automated bookkeeping offers live dashboards to display cash flow, outstanding invoices and VAT liabilities. This gives owners the freedom to take timely actions — whether that means pursuing late payment collections, reducing expenses, or making investments.

Firms that introduce accounting automation will have a definite advantage. They make quicker, evidence-based decisions, escape the penalty of suspected non-compliance, and are better equipped to handle more transactions without strain. Companies that are resistant to automation will likely lag behind their competitors, who prioritize the use of digital technology.

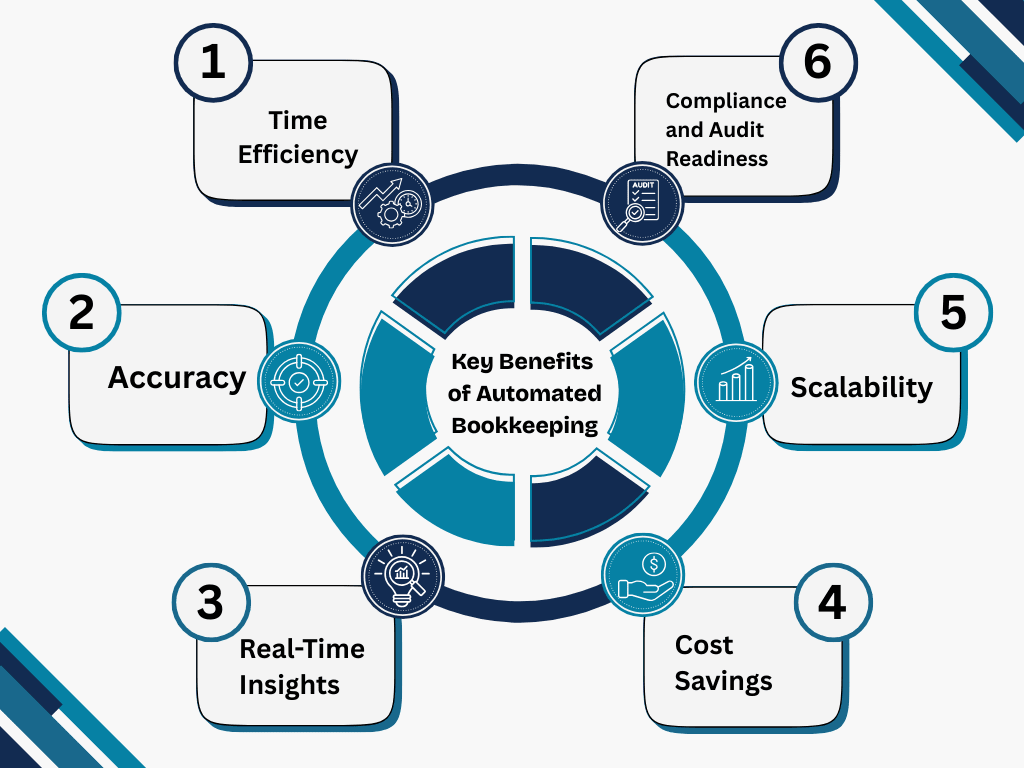

The question is, why do businesses need to invest in automating bookkeeping? The following are the best benefits explained in detail:

It is time-consuming with manual data entry and reconciliation. Automation also eliminates the need to perform these time-consuming tasks manually, such as scraping information from bank accounts or other invoices and receipts. A business owner can save tens of hours each month, which can be diverted to serving customers, driving sales, or fostering growth.

Compliance risk, improper VAT, and overreported profits are the worst consequences that can result from errors in human bookkeeping. Automated bookkeeping reduces these inaccuracies by importing error-free information directly from the source. This is particularly crucial in the case of HMRC audits, where any discrepancies may result in sanctions.

Instead of reviewing the monthly report, business owners will receive an up-to-date financial dashboard. These are present cash balances, expenditure patterns and eventual tax payments. Decision-making becomes proactive as opposed to reactive, which helps businesses to be financially agile.

Automation also saves on the salaries that could be incurred due to the requirements of large teams of people to do the same processes. It also minimizes the need to outsource basic bookkeeping services, which many companies now pay agencies to undertake. The ROI is evident: lower costs, improved record tracking, and enhanced financial understanding.

Businesses grow larger, and more transactions need to be undertaken. Such pressures are likely to cause manual bookkeeping to break down, causing delays and inaccuracies. However, automated systems scale quite easily to thousands of transactions - without any increase in effort.

Among the most significant advantages of automating a bookkeeping process is that of simplified compliance. Digitalized records, which meet the requirements of MTD and provide a clear audit trail, are recorded and maintained by automated systems. This helps make HMRC inspections less challenging and reduces stress during tax season.

Automation tools are not all made equal. The most suitable alternative varies depending on the size of the business, its structure, and the industry. The above are the most reliable automated bookkeeping software that businesses use in the year 2025:

Xero: A cloud-based accounting program that is entirely VAT prepared and connects with hundreds of apps. Easy to use, popular among SMEs and functionality requirements set as it will be MTD compliant.

QuickBooks Online: Used by freelancers and small companies. Vigorous invoice automation, expense classification and tax preparation.

Sage Business Cloud: The accounting brand that the business can trust. Includes payroll, cash flow forecasting, and is entirely MTD compliant.

Zoho Books: Scalable, cost-effective and available with AI-based automation of transaction classification and reporting. A sound choice by emerging SMEs.

FreshBooks: Perfectly suited for service-based businesses. Includes features of recurring invoicing, expense tracking, and time-tracking in one application.

Software solutions aim to address various requirements, and some will be more compliant, while others will be more scalable or cost-efficient. The best option depends on the field, your trading volume, and your future business objectives.

That bookkeeping can be automated is no longer the prerogative of the large corporation with huge budgets. It is increasingly becoming a wise investment, regardless of business size.

Startups: Automation of bookkeeping will help businesses save several hours every week that are spent on manual physical tasks. Rather than employing a full-time bookkeeper early on, startups can reduce expenses while keeping their accounts up to date and compliant with HMRC regulations. Automation helps avoid errors and keep financial data organized, even at the initial stage of work in a small team.

SMEs: Small and medium-sized enterprises more often than not are faced with challenges of limited resources. With accounting automation software such as Xero or QuickBooks, SMEs can remain compliant with the Making Tax Digital (MTD) requirements and process transactions more efficiently, with reduced VAT return processing.

Expanding businesses: The more transactions, the less feasible it is to input data entry manually. The possibilities of automated bookkeeping enable full-scale companies to manage thousands of invoices, payments, and reconciliations efficiently, minimizing the risk of audit complications and providing convenient conditions for financial reporting.

Accountants and outsourcing service providers: Firms that operate with a large number of clients are the greatest beneficiaries. Automation tools can help accountants work with large amounts of data, ensure accounts are reconciled efficiently, and allow their advisory skills to receive full attention rather than being diverted to repetitive clerical work.

Anyone who wants to improve their financial management can benefit from this approach. Even freelancers, contractors, and family-run businesses can use automation to gain real-time insight into their cash position, prevent fines, and spend more time developing their business.

Although automated bookkeeping can deliver significant benefits, it also presents its share of challenges that business organizations should address.

Initial cost: Software subscriptions, setup, and integration can be a challenge for micro-businesses. These costs are often outweighed over time by the savings that are achieved in staff time and compliance penalties.

Employee training and adaptation: Employees accustomed to using traditional spreadsheets may be reluctant to adopt automated systems. Training sessions are required, and transparency in working processes is necessary to facilitate adoption.

Critical dependency on automation: This can lead to blind spots when over-reliance on automation occurs. Even after a business conducts a regular review of reports, it should recognize the importance of reviewing these reports to identify anomalous or incorrectly classified data.

Cybersecurity threats: Cloud-based accounting software is generally safe, but it is not entirely proof against threats. The companies will have to resort to multi-factor authentication and select providers that comply well with GDPR and encryption principles.

Balanced viewpoint: Although there are risks associated with automation, the efficiency, accuracy and compliance improvements that automation offers are overwhelming in the long term. The trick is just to plan adoption and exercise control.

Transitioning out of manual spreadsheets or old systems and moving to automation should be done methodically. The companies should consider the following steps as a way to make the transition smooth enough:

1. Evaluate existing bookkeeping inefficiencies: See which of your bookkeeping activities erode a lot of time, such as invoice matching or manual VAT returns preparation.

2. Select an appropriate software solution: SMEs tend to use QuickBooks or Xero, while larger companies prefer Sage or NetSuite, which helps scale up and can be customized to meet specific needs.

3. Migrate old data safely: Transfer historical data without any loss and move old values to ensure conformity and prevent compliance gaps.

4. Train personnel and allocate positions: Ensure that employees are familiar with using automation tools, understand permissions, and can adapt to new processes.

5. Connect with your systems: Integrate bookkeeping software with payroll, bank accounts, invoicing tools, and HMRC APIs to streamline reporting as smoothly as possible.

6. Test and monitor: Until you have sufficient experience and are satisfied with the accuracy, run parallel reporting for a few months and fine-tune workflows and automation rules.

A phased implementation will help avoid inconsistency in financial reporting and, more importantly, ensure accounting standards are met.

The future of bookkeeping is currently in a state of growth, with AI-oriented bookkeeping becoming increasingly advanced every year.

Machine Learning and AI are leaving the era of mere data entry. Predictive analytics has been integrated into tools to help predict cash flow, identify late payments, and facilitate more effective financial planning.

Detection of fraud is transforming. AI can identify anomalies and suspicious transactions more quickly than a human and minimize the likelihood of financial abusive practices.

Linking with the HMRC is growing. With Making Tax Digital moving ahead, in-built bookkeeping applications will automatically integrate with the HMRC to offer real-time compliance and electronic submission of tax.

Altering the work of bookkeepers. Depending on the data, clerical work will be automated; however, bookkeepers and accountants will be transitioned to a new role, advising businesses on how to interpret financial numbers and make informed decisions.

Firms that embrace automation today will not only comply but also gain a significant competitive advantage in a future where the accounting industry is transformed into a digital environment.

Bookkeeping automation is no longer a choice that businesses can afford not to make. Whether it is a small business or a more mature enterprise, automation is essential for enforcing compliance, reducing expenses, and facilitating scalability.

Although there are challenges, such as training and cybersecurity, they can be addressed with proper planning and the assistance of professionals. Companies that adopt automation today will be better positioned to prepare for a future world of fully digital and AI-driven accounting.

At Aone Outsourcing, we help businesses make a seamless transition to automated bookkeeping, ensuring compliance, accuracy, and efficiency. Contact us today to automate your accounts and gain complete control over your finances.

With the aid of AI-enabled accounting software, automated bookkeeping can automate up to 90% of everyday accounting tasks, including documenting, classifying, and reconciling financial transactions, with minimal to no manual effort required. It guarantees conformity, precision and efficiency of business.

Xero, QuickBooks Online, and Sage Business Cloud are the top options that include features such as bank feeds, invoicing, payroll, and HMRC compliance.

AI is automating monotonous bookkeeping procedures, such as data input and reconciliation. However, there can be no replacement for human accountants in cases involving analysis, strategy, and compliance decisions.

Yes, accounting automation is expected to grow under Making Tax Digital (MTD), AI, and real-time reporting, enabling faster and smarter compliance and financial management.

The bookkeepers will then transition to a consultancy business that advises them on insights, tax strategies, and growth when they automate.

ChatGPT can discuss bookkeeping and answer accounting questions, but you will require specialized accounting software, such as Xero or Sage, to ensure compliance and maintain accurate records.

It also links directly to bank accounts, invoicing, and payroll, automatically updating ledgers, reconciliations, and providing up-to-date financial reports.

QuickBooks AI, Xero automation, and Zoho Books AI are all well-established solutions that provide automated reconciliation, reporting, and cash flow forecasting.

Indeed, financial workbooks and spreadsheets can be created using AI. Nonetheless, they should be reviewed by a qualified accountant to ensure accuracy and compliance with standards.