GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Every year, thousands of people across the UK leave their Self Assessment Tax Return to the last minute and end up missing something important. A forgotten expense, an income you didn’t report properly, and suddenly you’re hit with HMRC penalties, interest, or even a compliance check.

If you’re self-employed, a landlord, or a small business owner, these mistakes don’t just cost you money, they waste your time and cause unnecessary stress.

Filing your own taxes can feel confusing. What expenses can you claim? Should you register as a sole trader or consider another business structure? And what’s changed since last year?

Whether it’s your first time filing or your tenth, this guide breaks down the key do’s and don’ts of Self Assessment. You’ll learn how to stay compliant, avoid common pitfalls, and file with confidence. And if it still feels overwhelming? It might be time to let a tax pro take over like Aone Outsourcing Solutions.

A Self Assessment Tax Return is one of the official method by which HMRC collects income tax from individuals whose income isn’t taxed at the source. In simpler terms, if your earnings aren’t automatically taxed via the Pay As You Earn system like salaries are you’re likely required to complete a Self Assessment. This system places the onus on you, the taxpayer, to report your earnings accurately and pay the appropriate tax.

This applies not only to freelancers and sole traders but also to individuals with multiple sources of income, investors, landlords, company directors, and even employees with complicated tax situations. If you fall into one of these categories and fail to submit a return under the tax return HMRC self assessment system, HMRC may issue you with penalties, interest on unpaid taxes, or both.

Understanding whether you fall within the scope of Self Assessment is crucial:

Individuals who are self-employed or sole traders (this includes those required to file a self employed tax return UK)

Business partners

Company directors

Individuals earning more than £100,000 per year

Landlords who earn rental income

Those receiving foreign income

Individuals with complex investment portfolios or capital gains

If you’re unsure, it’s always better to check your circumstances via HMRC’s online eligibility tool or consult a self assessment accountant to confirm your obligations.

Missing a Self Assessment deadline isn’t just a paperwork problem, it’s an important financial task. HMRC doesn't take kindly to late submissions or payments, and even a one-day delay can cost you.

Here is what every individual, small business, and accounting firm should know:

5 October: This is deadline to register for Self Assessment, if you’re a first-time filer.

31 October: Paper tax return submission deadline (rare these days, but still an option).

31 January: Deadline to file online and pay any tax owed for the previous tax year.

31 July: Second payment on account deadline (if you’re required to make one).

Missing the 31 January deadline? That’s an automatic £100 fine, even if you owe nothing. Miss it by 3 months? The fines keep stacking.

And if you're juggling multiple clients as an accountant or firm, these dates aren’t suggestions, they’re non-negotiable. A missed return not only affects your client’s wallet but also reflects on your firm's reliability.

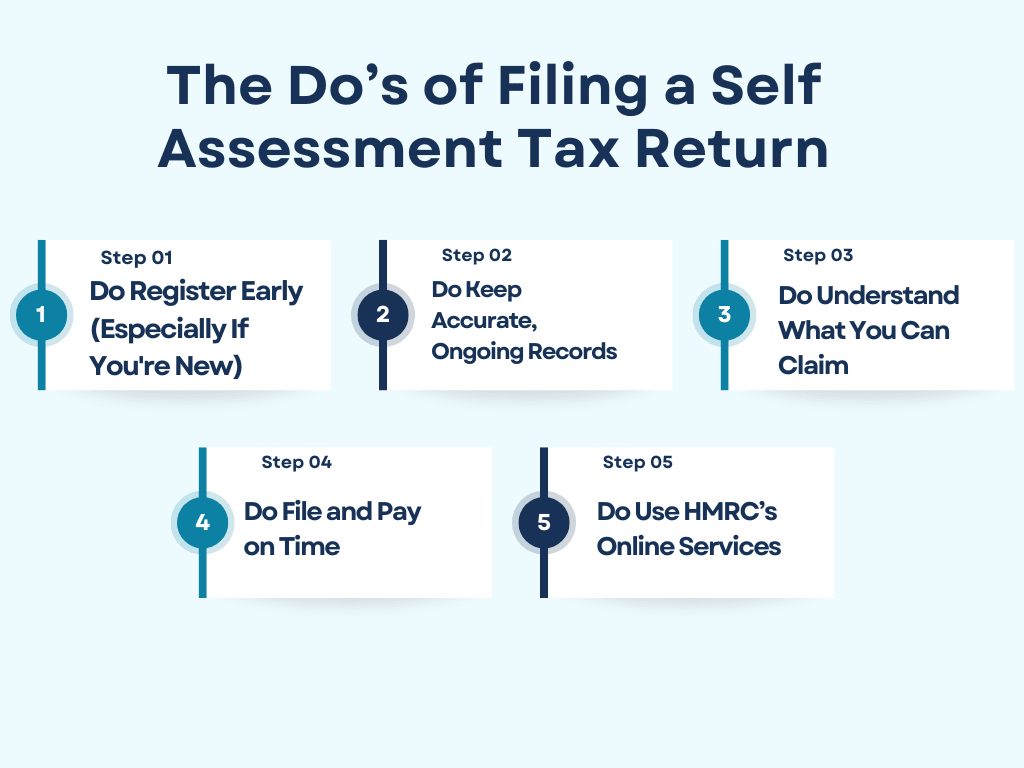

If you want to get your Self Assessment right the first time, there are a few best practices that can save you from common errors and from HMRC’s radar. Whether you’re a freelancer crunching numbers after hours or a landlord managing multiple properties, these ‘do’s’ are your tax season survival guide.

If you’ve never filed a Self Assessment before, don’t wait until October to register. The process can take time, especially if you need a UTR (Unique Taxpayer Reference) and haven’t interacted with HMRC much before. Aim to register months in advance to avoid delays that could snowball into missed deadlines.

Pro Tip: HMRC recommends registering by early September if you’re new. That gives you time to receive login details, set up your online account, and prepare your documents.

This is the golden rule. Don’t rely on last-minute number-hunting when January hits. Use accounting software (like Xero, FreeAgent, or QuickBooks), spreadsheets, or even a dedicated bookkeeping service to keep everything in order throughout the year. Income, expenses, receipts, mileage, invoices, track it all.

Bonus Tip for Side Hustlers: Even if your earnings are irregular or small, HMRC still expects accuracy. Keeping digital records will also prepare you for Making Tax Digital requirements.

Allowable expenses can significantly reduce your tax bill—but only if you know what counts. If you’re self-employed, you can often claim for things like:

Home office costs

Business mileage

Software and subscriptions

Marketing and advertising

Accountancy fees

Don’t guess, either research properly or work with a self assessment accountant who knows your sector.

This may seem obvious, but you'd be surprised how many people miss the deadline due to simple forgetfulness. Mark 31 January and 31 July (if applicable) in your calendar—and maybe set a few reminders. Even if you can’t afford to pay in full, submit the return. HMRC fines are steeper for non-filing than for non-payment.

Filing online is faster, more secure, and gives you instant confirmation that your return has been received. You can also access calculators, submit queries, and set up payment plans through your HMRC account.

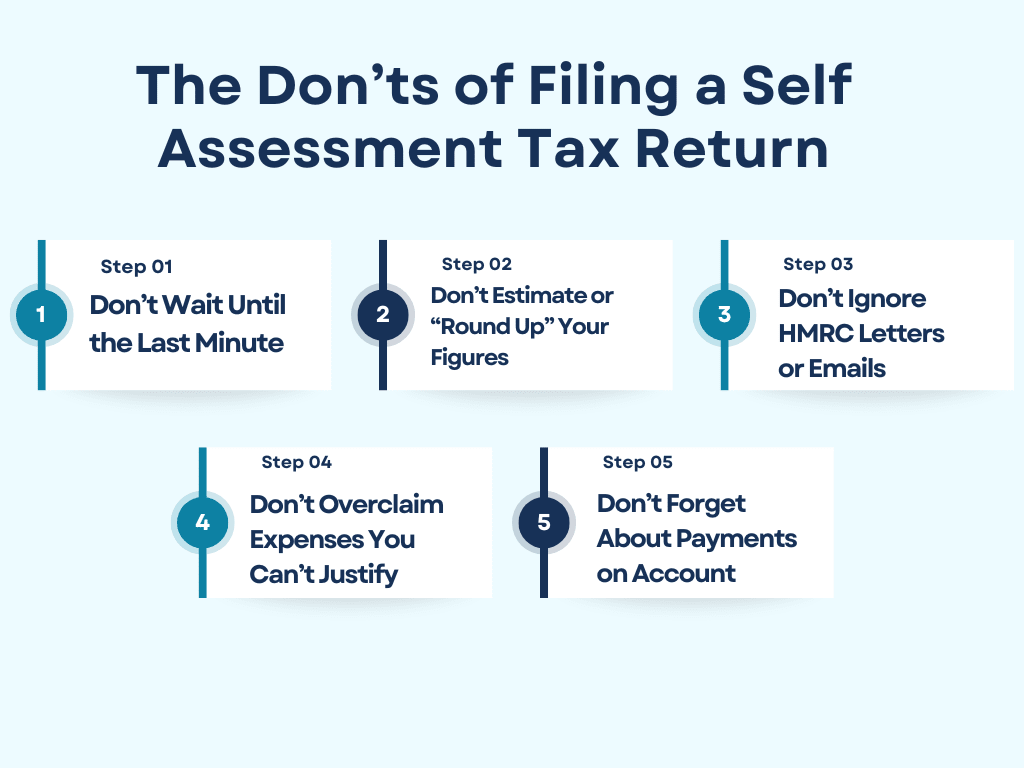

Knowing what not to do is just as important as ticking the right boxes. A single oversight or assumption can cost you more than just peace of mind. Whether you're an individual freelancer or an accounting firm juggling multiple submissions, these common mistakes can land you (or your clients) in hot water.

You’d be surprised how many people log into their HMRC account on 30 January thinking they can “just finish it off in an hour.” Spoiler alert: They can’t. Whether it’s waiting for a UTR, chasing missing documents, or getting stuck on a confusing form you need buffer time. Don’t gamble with the deadline.

Real Talk: HMRC’s system gets overloaded in the final days before 31 January. Slower site, login issues, longer helpline queues, it’s a stress cocktail you don’t want.

HMRC doesn’t appreciate guesswork. Whether it's your income, expenses, or dividends—accuracy matters. Don’t round numbers to the nearest hundred or estimate based on last year. Not only could you miss out on legitimate claims, but it could also raise a red flag for audits.

For Accounting Firms: Teach clients the importance of proper records. If they're giving you napkin math, it’s time for a serious chat.

See an email from HMRC and think “I’ll check that later”? Don’t. It could be a notification about missing details, changes to your tax code, or a follow-up on a submission. Ignoring these messages can lead to penalties—or worse, a default judgment on unpaid tax.

Yes, you want to reduce your tax bill. No, that doesn't mean claiming your entire family holiday as a “business trip.” HMRC has detailed guidelines on what’s allowable—and they do ask questions. If you can’t clearly prove it was wholly and exclusively for business, leave it out or speak to your accountant.

If your tax bill is over £1,000, you’ll likely be required to make payments on account—half in January, half in July. Many people forget the July one, thinking they’re “done” after January. That second payment can sneak up on you and cause cash flow issues.

Filing your Self Assessment Tax Return doesn’t have to be a last-minute scramble or a source of panic. With the right approach and the right knowledge, you can stay compliant, avoid penalties, and even spot opportunities to reduce your tax bill legally.

Whether you're a first-time filer, a seasoned sole trader, or juggling multiple income streams, the key is preparation. Be aware of deadlines, maintain accurate records, and understand HMRC's expectations. And if in doubt, ask for help, because when it comes to taxes, guessing can get expensive.

At Aone Outsourcing Solutions, we take the hassle out of tax season. Our experienced accountants help individuals and businesses across the UK file with confidence, minimise errors, and avoid unwanted HMRC surprises.

Stop worrying about missed deductions, incorrect figures, or looming HMRC penalties. Our experienced tax professionals make sure everything is accurate, on time, and fully compliantso you can file with confidence.