GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Accounts Payable (AP) is one of the most important functions in any business. It’s where your payments, invoices, vendor relationships, and cash flow all come together. And when it’s time for an AP audit, accuracy, organisation, and transparency are critical.

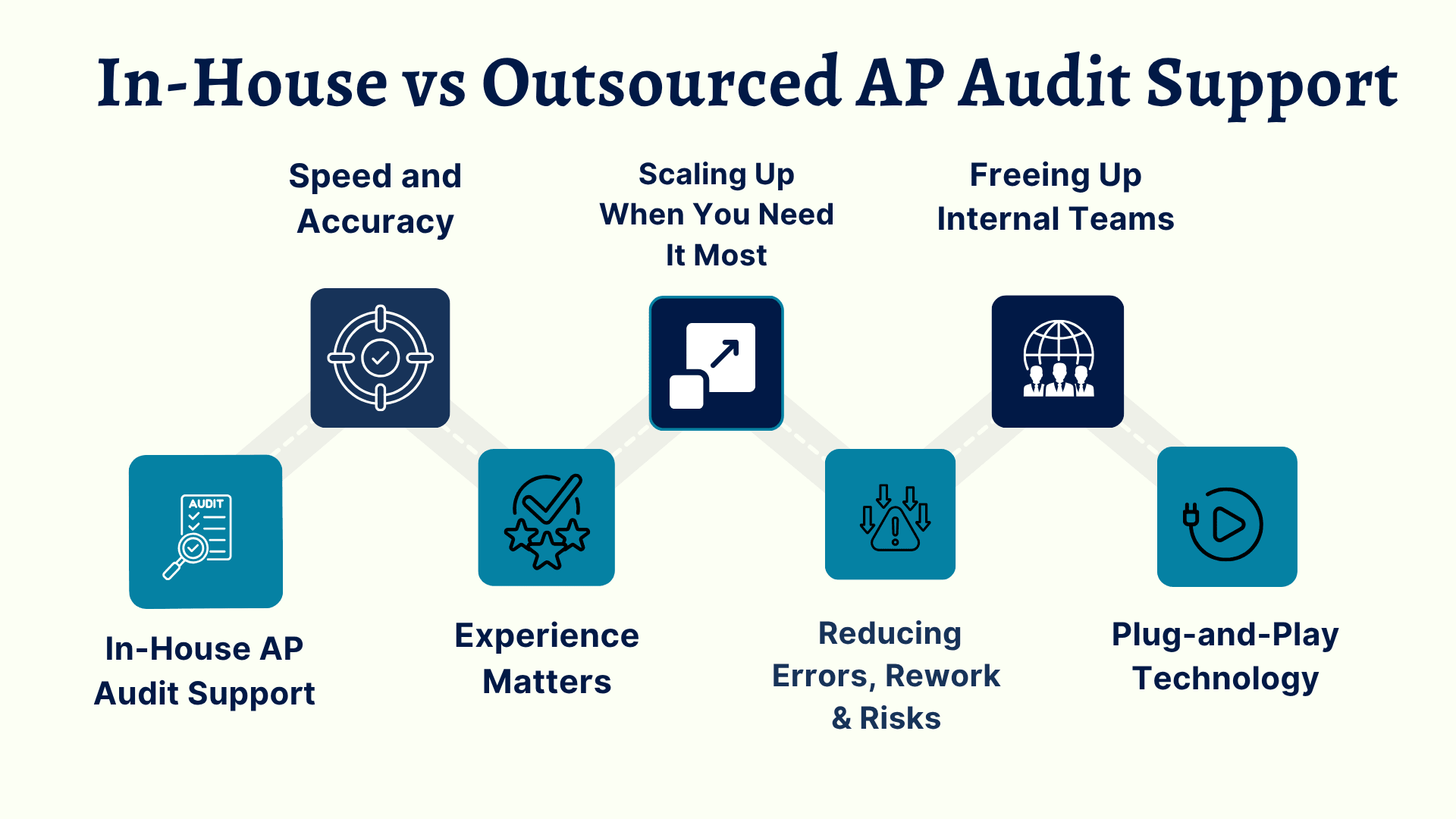

But here’s the truth: handling AP audits in-house is getting harder every year.

Your finance team is already busy managing day-to-day payables, dealing with payment deadlines, resolving vendor issues, and keeping up with compliance rules. Now add audit prep to the list, digging through invoices, reconciling numbers, answering auditor queries, fixing past mistakes and suddenly, your entire team is stretched to the limit.

That is why more businesses and accounting firms are choosing to move away from fully in-house AP processes. Instead, they’re turning to outsourced AP audit support, a smarter, more scalable solution that brings expertise, automation, and efficiency into your workflow.

And this shift isn’t just about saving money.

It’s about reducing stress, meeting deadlines faster, improving accuracy, and giving your in-house team more time to focus on strategy, client service, and growth.

In this blog, we’ll explore the differences between in-house and outsourced accounts payable audit support, the risks of sticking to outdated systems, and why outsourcing has become the best strategy for firms that want to stay ahead.

Running an in-house audit process sounds simple. But in practice, it means juggling multiple tasks across finance teams that are already stretched thin. Your staff needs to manually collect and reconcile documents, double-check entries, correct errors, and prepare responses to auditor questions. This slows everything down and increases stress levels during already busy seasons.

On top of time, there’s the cost of hiring, onboarding, and training AP specialists, especially in a competitive talent market. You’ll also need to invest in tools, licenses, and cybersecurity infrastructure to meet audit requirements. These hidden costs are often overlooked when evaluating in-house options.

By contrast, outsourced accounts payable services offer a predictable, all-in-one pricing structure. You get access to an expert team, enterprise-grade tools, and audit-specific processes at a fraction of the internal cost. Most importantly, your internal resources remain focused on growth initiatives.

Pro Insight: Outsourcing AP audits can reduce internal costs by 30–50% and free up over 40% of your finance team’s capacity during critical periods.

In-house AP audit prep is often slowed down by manual systems, scattered spreadsheets, and inconsistent documentation. This creates unnecessary bottlenecks, especially when audits are unplanned or under tight deadlines.

Outsourced providers bring in Accounts Payable Automation tools that streamline your workflows. Invoices are automatically matched to purchase orders, data is digitised, reports are generated in real time, and every step is tracked in the system. No more chasing files or second-guessing amounts.

When you combine human oversight with automation, your audit results improve dramatically. Errors are reduced, reports are accurate, and auditors can access clear records quickly. This not only speeds up the audit itself but also improves compliance across your AP process.

Bonus Benefit: Automated audit trails make it easier to identify fraud, overpayments, or vendor miscommunication early.

Your in-house accounting team might be amazing, but their focus is likely spread across payroll, taxes, client reporting, and vendor payments. Auditing is just one more responsibility on a long list—and often not their strongest skill.

Outsourced AP work their way audit services are skilled specialists. They will lead the accounts payable processes and compliance reviews. These teams are trained in :

UK and global audits standards

Multi-vendor & Multi – entity Reconciliation

Auditing knockouts

VAT legislation, MTD compliance and internal audit.

Instead of spending weeks getting up to speed, they jump in with ready-to-go frameworks, proven processes, and quality checks that align with your goals.

Did You Know? Outsourced audit teams can reduce the risk of audit rejections or fines by over 50% compared to firms using internal-only staff.

Audit periods often overlap with year-end reporting, VAT returns, and tax filings. Your internal staff is already swamped. If someone resigns, takes leave, or falls ill, deadlines suffer and audit quality slips.

Outsourced AP audit support gives you the ability to scale instantly. You can ramp up resources during busy periods and scale down when demand drops. Whether you need two extra hands or a whole team for a quarter, your outsourcing partner adapts to your timeline.

This flexibility not only keeps your projects on track but also prevents burnout in your core team allowing you to maintain consistency and client satisfaction.

Real Value: Aone Outsourcing clients report 3x faster audit turnarounds during peak seasons thanks to flexible staffing models.

When it comes to AP audits, even small errors can lead to big consequences—missed payments, duplicate invoices, and wrong ledger entries can trigger audit flags or HMRC penalties.

Outsourced AP audit support is built around quality. Providers use layered review systems, performance KPIs, and SLA-backed accuracy guarantees. Data goes through multiple rounds of checks before it reaches the auditor.

This reduces the need for back-and-forth corrections and re-audits. You also get consistent documentation, clearer audit trails, and better risk visibility across vendors and payments.

Pro Tip: Choose outsourcing partners who include compliance metrics, checklists, and audit dashboards—these reduce stress during actual audits.

Let’s be honest—your internal team wasn’t hired to spend hours compiling invoice reports or cross-checking payment approvals. Their time is better spent on forecasting, budgeting, and advising on business strategy.

By outsourcing AP audit support, you offload repetitive, time-consuming tasks and unlock capacity for high-impact finance work. Senior accountants and partners can focus on insights, not admin. Junior team members can grow in their roles instead of getting buried in spreadsheets.

This shift creates a more motivated team, better output, and a culture focused on performance—not just compliance.

Smart Move: Use outsourcing to build a dual-engine model—routine AP work offshore, strategy in-house.

One major concern many firms have is: "Will outsourced teams work with our systems?"

The short answer: Yes.

Top AP outsourcing providers use the same platforms you already use—Xero, QuickBooks, Sage, Dext, ApprovalMax, SAP, and others. There’s no need for major IT overhauls or migrations. These partners plug right into your system, access data securely, and produce reports in your format.

And with client portals, real-time dashboards, and cloud-based tools, you can monitor every stage of the audit process. It’s collaborative, controlled, and customisable.

What You Get: Secure file sharing, version control, e-invoice processing, audit trails, and instant report downloads—no manual backlogs.

At Aone Outsourcing Solutions, we are specialists in simplifying back-office finance functions in UK, US and international companies.

Specialized AP audit staff qualified in the domestic laws

Connection with your cloud-based systems (Xero, Sage, SAP, etc.)

Real-time reporting dashboards in a secure manner

Accuracy and turn around guarantees with SLA backing

Scalable firm solutions of any size

It does not matter whether you need to pass your next outside audit, or want to secure the future of your AP process, we are here to give you back some control.

Managing AP audits in-house is no longer the only option—nor is it always the best. As technology advances and workloads grow, businesses need agile, error-free, and affordable solutions to stay ahead.

Outsourcing your AP audit function gives you more than cost savings. It gives you control, transparency, expert support, and time back to focus on what really matters—running and growing your business.

Ready to explore outsourced accounts payable audit support?

Let’s talk. Aone Outsourcing is here to streamline your AP process and help your next audit run like clockwork.