GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

There has been tremendous expansion in the UK e-commerce industry, with more people shopping online than anybody can remember. Even with the new chances offered by this boom, e-commerce accounting is now more complicated than it used to be. For anyone selling products online, managing multiple payment channels and making sure they obey new VAT regulations leads to many administrative difficulties.

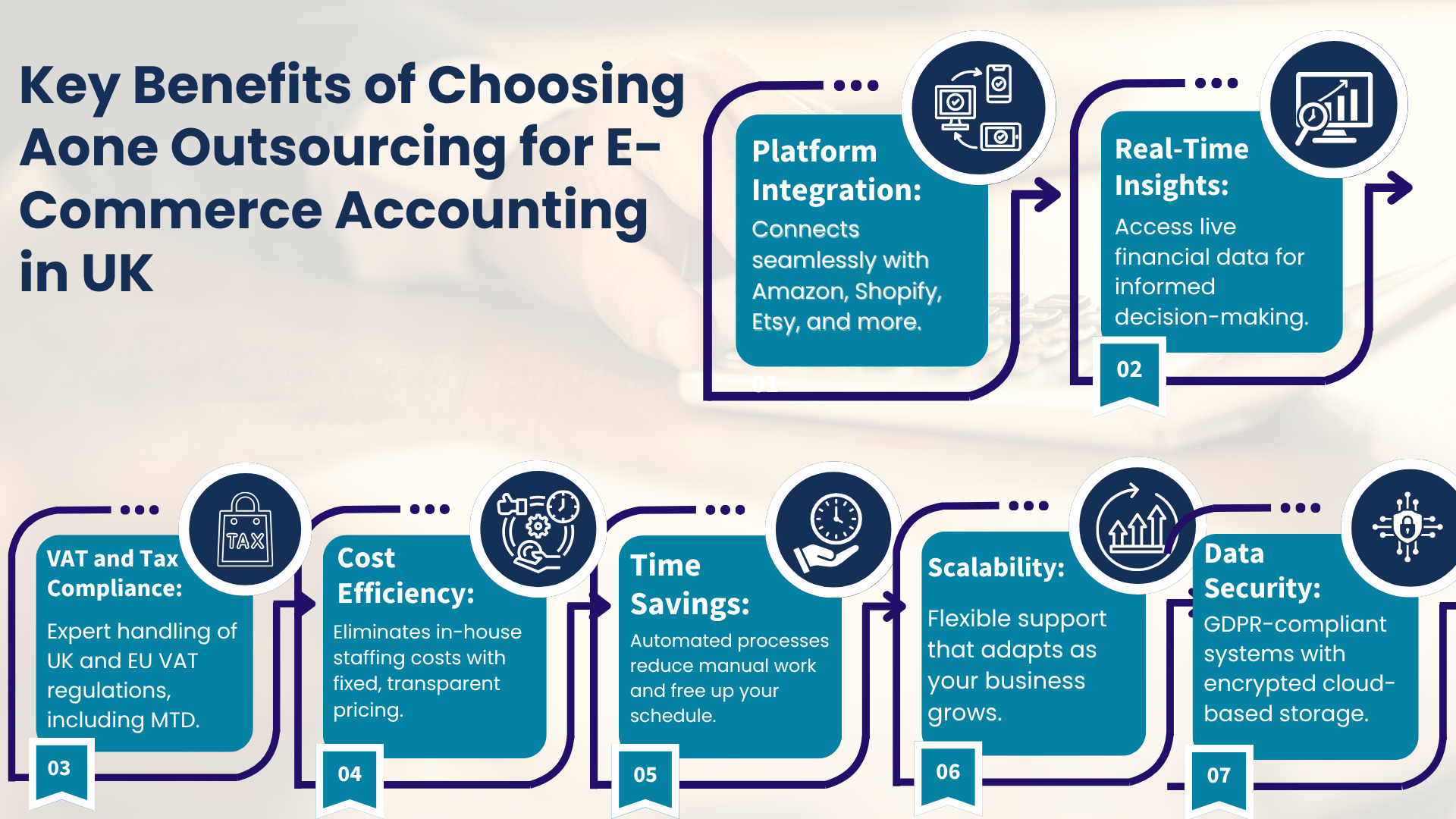

As a result, many businesses have turned to outsourced e-commerce accounting services to save time and stay accurate while they develop their businesses. Aone Outsourcing provides UK e-commerce businesses with specialized online accounting support to help make their finances easier to handle and more certain.

If you choose outsourced e-commerce accounting, you pay an external company to take care of all the accounting tasks connected to your e-commerce business. Organizations prefer to depend on e-commerce specialists to deal with their financial operations.

Most virtual services cover bookkeeping, making VAT and tax declarations, handling payroll, reporting finances, and creating links with e-commerce sites. Services are usually run through the cloud, so financial information can be checked in real time from any location.

Aone Outsourcing creates special e-commerce accounting plans that match your company’s structure. Whether data is synced on Amazon or Shopify, or it’s time to prepare accurate VAT reports, their team takes care of everything, making sure everything is clear so you can grow your business.

With online sales increasing, financial management also becomes more complicated. The following problems are common challenges encountered by UK e-commerce businesses currently:

The Challenge of Multi-Platform Sales: Tracking sales from all three platforms, Amazon, Shopify and eBay makes it hard to unite transactions and check the accounts carefully.

New Revenue and Customs for VAT after Brexit: The adjustments to VAT laws from Brexit, along with the new way imports are treated, result in extra work for tax filings and calculations.

Making Tax Digital (MTD) Compliance: Under MTD, the UK asks businesses to keep digital records and send VAT returns on time, so businesses should have current and suitable financial systems.

Changing Currency and International Deals: Dealing with a mix of currencies for international purchases increases the challenge in accounting and may change profit numbers.

The Risk of Failing to Pay Attention: Generating errors in handling VAT billing, bookkeeping, or tax filing without proper guidance can result in expensive fines and penalties.

Outsourcing accounting services may not be necessary for a business at the start, but some signs reveal it can be beneficial. More than 37% of small businesses in the UK are already relying on virtual accounting and bookkeeping services for improved accounting results. It’s time to see when outsourcing makes the most sense and is the best decision:

Team Members Feel Overloaded: As soon as your team finds it hard to catch up with daily accounting, outsourcing can ease work and guarantee a correct outcome.

Fast Company Growth: When a business scales fast, the volume and difficulty of financial transactions increase, making it hard for internal teams to handle things promptly.

Regular VAT Errors or Missing Deadlines: Handing over your business’s VAT work to a professional organizer will prevent many penalties if you keep making errors.

Insufficient Knowledge in E-Commerce Accounting: Special knowledge is needed for e-commerce accounting; hiring an outsourced service gives you access to those familiar with e-commerce platforms and tax rules.

Entering into New Areas: When firms start doing business worldwide, they meet new tax and compliance rules that outsourcing companies can handle.

Factors Related to Cost and Efficiency: Relying on outsourced services is often more affordable for small to medium-size companies than bringing on new in-house employees.

Selecting the best outsourcing company for accounting can completely transform your process. Find out how Aone Outsourcing supports your e-commerce business with their skill and specialized services here:

We are familiar with the unique problems found in e-commerce platforms like Amazon, Shopify, Etsy and WooCommerce. By syncing sales numbers, fees, refunds and changes in stock, our systems avoid making mistakes and let you save time.

It is not always easy for businesses to comply with the UK and EU VAT standards, including the OSS/IOSS schemes. Our team guarantees you comply with VAT returns and tax filing rules, both the typical laws and the new Making Tax Digital law. Quick and correct financial document submissions help you dodge penalties and stay in shape for audits.

Getting accounting help from Aone means you don’t have to spend on hiring, training, or purchasing software. We built our packages to be affordable and simple for small and medium e-commerce owners so they can work with expert help without any unexpected costs.

When you delegate accounting, you have more time to focus on expanding your business and improving what your customers get. Automation of our reporting and bookkeeping tasks means we give you regular updates on your finances and eliminate much of what you were doing manually.

We adapt our services to support your business if you encounter seasonal increases or grow into new areas. Our packages are designed to change with your business needs, making sure you aren’t over- or under-supported.

You can review simple dashboards and current financial statements anytime you like. These insights support data-based choices, so you can oversee your cash flow, business costs, and tax responsibilities, making it easier to plan for the next steps.

Having the right accountant is very important when growing your e-commerce business. Here’s the reason UK e-commerce businesses rely on Aone Outsourcing:

A Proven History: With our clients in the UK e-commerce sector, we have demonstrated experience helping in various industries and understanding what financial difficulties they face.

Skilled Accountants: The accountants on our team know leading accounting apps and platforms which helps them ensure successful integration and right reports.

Support for Each Client: Account managers focus on individual guidance, so each client can easily and efficiently work with our team.

Positive Client Testimonials: Our client feedback shows that our services are dependable and of great quality.

Outsourcing e-commerce accounting is a wise decision that improves how UK businesses handle their finances. It helps businesses follow tax rules, decreases likely mistakes, and allows them to concentrate on creating new ideas and growth.

Partnering with Aone Outsourcing ensures you have a skilled expert on your side who pays attention to your business, scales with your demands, and provides security and high accuracy. Make your accounting more efficient now and watch your online business move forward confidently.

Your success in e-commerce will be boosted with your contact with Aone Outsourcing.

In most cases, e-commerce businesses find that accrual accounting works the best. It keeps track of both income and expenses each time they are earned or billed, not when the cash trade occurs. As a result, the performance of the business is shown more precisely, mostly when managing inventory, various sales channels and international transactions.

The price for hiring an accountant in the UK depends on the accountancy needs and the size of your business. E-commerce companies may save a lot of money by outsourcing to a specialist team like Aone, instead of hiring an in-house accountant. Fixed and clear packages are usually available from the beginning, starting at around £200–£300 each month.

By outsourcing, e-commerce businesses can rely on a secondary service provider for tasks including accounting, bookkeeping, VAT, and managing inventory. For accounting, this includes hiring a team that works separately with cloud tools, so you can focus on making more sales and growing your company.

If you want to get clients for outsourced accounting, work on building trust and display your expertise. This includes:

Making case studies and testimonials using positive feedback from clients

Work on boosting your site for SEO and selecting the right keywords.

Offering a first consultation or assessment for free

Taking part in groups focused on a particular industry (e-commerce)

Offering services designed for sellers on Amazon and Shopify

We at Aone Outsourcing have noticed that our customers stay and refer us when we provide personal care and consistent outcomes.