GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Is your expanding UK operation wasting so much time struggling with tax returns?

To various ambitious businesses, the tax return preparation process is a never-ending hill that sends everyone into a downward spiral. This is a drain of valuable resources and energy on the core business.

The internal administration of complex taxation is becoming costly. It is not merely filling forms, but rather keeping abreast with the legislation, being precise to the point, and immaculately preventing errors, which can be costly. This burden of administration usually has the effect of distracting you from the area of innovation and growth.

This is where the outsourcing of tax return preparation services can come to the rescue in offering a strong strategic solution. Through tax outsourcing, your UK company can achieve significant cost savings through time management, comprehensive compliance, and speeding up its growth. Come along with us and understand why outsourcing tax is a step in the right direction to successfully establish any business in the UK, the benefits of tax outsourcing, and how to select an ideal tax outsourcing partner.

The UK Tax is notorious for its complexity and restlessness. There are numerous requirements that businesses have to undergo. This is Corporation Tax on profits (maximum 25%), VAT on sales (standard rate 20%), PAYE, and National Insurance Contributions (NICs) of employees. Landlords and self-employed people also do Self-Assessment. Do not overlook capital gains tax on selling assets, as the growing firms compound these properties.

The growing firms compound this. Other factors that compound how difficult it is to comply with tax diligently are elevated trading levels and more complex financial arrangements. Each new branch or a new hire must be another consideration against tax. Being up to date with rolling changes in legislation is an arduous task.

One of its key advances is the so-called Making Tax Digital (MTD) by HMRC. MTD requires the electronic filing of VAT and electronic returns. Now, many are going into a phasing in of Income Tax Self-Assessment (ITSA) in April 2026. This demands that companies operate MTD compatible software, with the quarterly updates and yearly declarations. Lack of compliance is not an option, but a non-negotiable transition.

These requirements pose considerable risks that should not be ignored. Mistakes, late entries, and lack of appropriateness might result in severe punishments, high fines, and even tarnishing your business reputation. Dealing with this environment in isolation is risky in its own right, so it is reason to outsource tax preparation services.

Tax return preparation outsourcing is tendering your company or business tax preparation and filing responsibilities to an independent tax speciality company. It is a matter of leaving these crucial financial processes to a group of specialists. This is not bookkeeping at the basic level, but includes the whole lifecycle in tax compliance.

Outsourcing of tax preparation is broad. It usually involves scrupulous data accumulation and structuring, after which the exact tax computation is made. Such a calculation means finding all the available reliefs and deductions to optimise your tax position.

The service provider then addresses accurate preparation of tax returns, e.g., CT600 Corporation Tax return, VAT returns, and SA100 Self-Assessment. Importantly, your tax preparation outsourcing company shall also deal with queries and correspondence with tax authorities, which your tax outsourcing company will deal with on your behalf.

Most providers also have optional advisory and planning services, which can assist you in planning to be tax-efficient in the future. Fundamentally, this transition removes the entire burden of operations and the compliance risk placed on your team to other individuals with experience in this area.

It is apparent that outsourcing tax return services is not only a trend but also a tactical decision to enhance the long-term growth of businesses in the UK. This is why more enterprises choose this clever move:

Taxes in the UK represent an environment of pitfalls. Tax return outsourcing services have present-day knowledge of all the UK taxes. They are also abreast with the changing HMRC rules, such as the Making Tax Digital (MTD).

Your risk in compliance becomes minimal when your specialists are easily accessible. This will prevent the expensive audits and drastic penalties. They make sure that your filings are on time and that they are always correct.

Each hour that goes into the excruciating approach of preparing all the taxes with a company that specialises in this type of tax outsourcing is an hour that takes away. This time can be used to work on your business mission.

Through professional outsourcing solutions, you free your internal finance groups and the owners of your businesses from the burdensome activities. They will be able to spend valuable hours on strategy initiatives. This means product development, expansion, new customers, and driving innovative sales. Such activities are directly driving revenue and growth.

It is very costly to sustain an in-house tax department. You are shelling out salaries, benefits, and training. Software licenses are also expensive and require tax software. Fixed expenses are avoided by outsourcing tax preparation services.

You simply pay what you consume. This converts fixed costs into variable costs. It averts costly penalties incurred due to mistakes as well. Professionals can find out the best reliefs so that they can significantly reduce their total taxes.

Professional outsourcing solutions also mean one can access a pool of experienced tax professionals immediately. Such professionals are experienced in different tax situations and sectors.

Also, well-established tax return preparation outsourcing firms spend on high-end tax preparation software and online tools. This implies that your firm will enjoy high-level technology. No significant upfront outlay or maintenance is required, which increases accuracy and productivity.

Your business expands, and so does your tax liability. The scalability provided to an employee is on an unprecedented level. They can absorb the enlarged workloads easily during peak tax seasons, such as the year-end or MTD quarterly filings.

This will avoid hiring temporarily or overworking the current personnel. On the other hand, on a lower demand, you become cost-efficient by using services as frequently needed. This gives an unTriumphant operational flexibility.

With the adoption of outsourcing tax return preparation, UK businesses open a box of numerous tangible benefits. Such advantages affect productivity, crime control, and the company's vision.

Time Savings: Make your team work free of tax return preparation. Get back their precious time to strategic financial analysis and business growth centres.

Improved Precision and Lower Errors: Get access to the qualified skills of professional outsourcing. This minimises errors drastically, thus minimising errors, audits, and penalties through strong quality control.

Forward Thinking Tax Planning: Besides filing, specialists note available reliefs such as those on research and development tax credit and capital deductions. That is the best tax planning as it reduces the tax you pay legally and increases cash flow.

Enhanced Data Security: Outspread tax preparation services guarantee first-rate data security. They employ GDPR compliance, ISO 27001, and encrypted portals to protect your sensitive financial data.

Business Continuity: A contracted partner will also ensure that your tax returns are filed on time despite a change in staff. This will bring smooth operations and compliance.

Less Stress and Peace of Mind: Outsource your tax issues and complications to tax return specialists. Enjoy ongoing relief, and concentrate comfortably on your business's running and development.

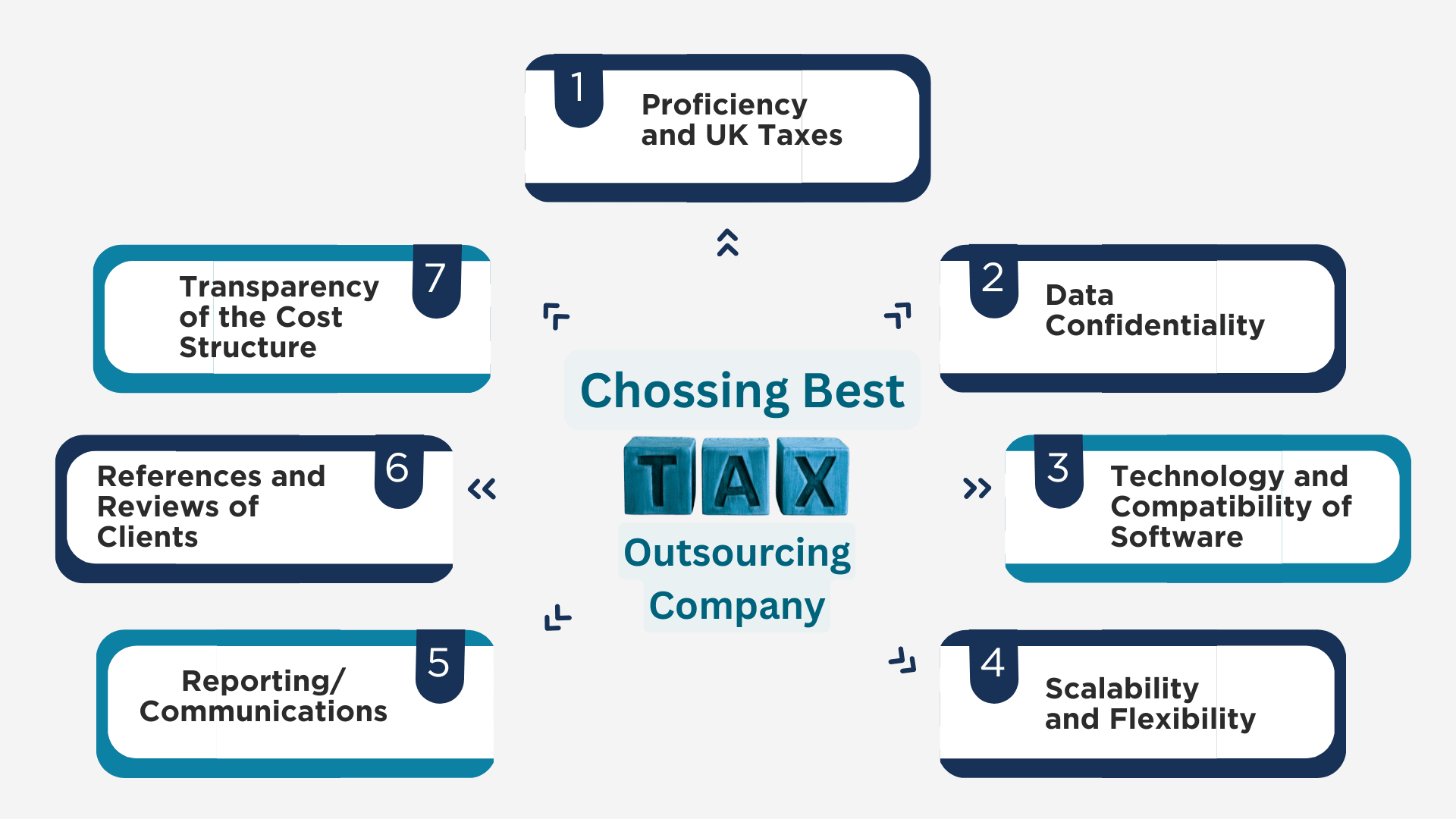

The most critical aspect of making full use of the tax preparation outsourcing services is selecting the right partner. This is not vendor selection but a strategic business partnership that helps your business grow and comply.

The most critical aspect of making full use of the tax preparation outsourcing services is selecting the right partner. This is not vendor selection but a strategic business partnership that helps your business grow and comply.

1. Proficiency and UK Taxes: Ensure profound knowledge of UK tax provisions, Corporation Tax, VAT, and PAYE. Ensure that they are well informed of Making Tax Digital (MTD) requirements.

2. Data Confidentiality: Emphasise strong data protection. Seek tough encryption, portals, and compliance with GDPR. ISO 27001 certification is a good pointer.

3. Technology and Compatibility of Software: Ensure that the software meets the MTD requirement and can integrate efficiently with your accounting system (e.g., Xero, QuickBooks).

4. Scalability and Flexibility: The partner should be able to deal with the changing workload in terms of seasonality and rapid expansion. Request the ease of the contract.

5. Reporting/ Communications: There should be clear communication and responsiveness. They need to give understandable accountability.

6. References and Reviews of Clients: Ask customers to nominate references that include similar companies. Social proof of reliability should be checked online.

7. Transparency of the Cost Structure: That is to demand a clean, clear pricing model without hidden fees. Ensure that the cost offers optimal results regarding the services being offered.

Tax outsourcing companies are not merely a convenience, but are a knowledge investment. It offers unrivalled efficiency to the expanding UK businesses, high compliance levels, and access to specialised expertise. This dynamic partnership liberates your team of administrative distractions and enables those teams to drive innovation and deliver on business growth.

Adopting a tax outsourcing service will save time, improve accuracy, and provide invaluable peace of mind. No more having complicated tax filings distract you.

Ready to simplify your tax system and concentrate on the essential things?

Make that call now to Aone Outsourcing and enjoy a free income tax preparation consultation to understand how we can help your expanding UK company with professional outsourcing services.

"Best" depends on your particular business needs. On the other hand, Aone Outsourcing Solutions is well known for offering large-scale UK tax return outsourcing to growing businesses. Seek experience in the taxation matters of the United Kingdom and good data safety (GDPR, ISO 27001), MTD readiness, and client feedback.

Yes, definitely. In the UK, outsourcing tax preparation is not illegal at all. Although the responsibility of tax compliance depends on the companies, the business can legally outsource the preparation and submission of documents to a trusted third-party provider. The key aspect of selecting a proper company is one that is legitimate and complies with all the information protection (GDPR) policies and taxes in the UK.

The price changes significantly depending on complexity. In the case of a basic Self-Assessment, it could be between $150 and $300. Simple cases such as rent or self-employment income may cost between $300- 600+. Complex returns with either capital gains or overseas income could be in the range of $600-1200+. There are also other possibilities when outsourcing is more economical.

India is consistently identified as the topmost destination for tax preparation and product outsourcing. This is attributed to its high population of professional, cost-effective, well-structured infrastructure, and good English language skills.

The cost reduction is a significant factor, but the overarching reason for outsourcing can be reduced to the simple fact that businesses should be left to concentrate on their core business. Outsourcing non-core services such as preparing tax returns enables the company to release its internal resources, improve efficiency, acquire specialist skills, and eventually generate more innovation and strategic development.