GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

As the fiscal year moves into full swing, VAT season begins knocking on every accountant’s door. Whether you're handling a few business clients or hundreds, VAT return deadlines are non-negotiable—and with the HMRC updating processes under Making Tax Digital (MTD), meeting the VAT deadline is more than just ticking a box.

2025 is an important year with new changes to VAT regulations, VAT deadlines, and electronic reporting obligations under the Making Tax Digital (MTD) project. These changes may affect how you account for and report VAT returns, whether you are a VAT-registered retailer in London, a service provider in Manchester, or an eCommerce seller operating internationally.

At Aone Outsourcing Solutions, we work alongside UK accounting firms to lighten their VAT return workload and improve compliance accuracy. That’s why we’ve prepared this in-depth guide to 2025’s VAT return due dates, penalties for late filing or payment, and submission strategies to keep you and your clients penalty-free.

A VAT return is essentially a report that businesses submit to HMRC, outlining the amount of VAT collected on sales and the VAT paid on purchases. This return is required from all businesses that are VAT registered—typically because their taxable turnover exceeds the VAT threshold, which as of 2025 is £90,000. Even businesses with lower turnover can voluntarily register for VAT to reclaim input VAT. These returns help HMRC determine whether a business needs to pay money to HMRC (if output VAT exceeds input VAT) or claim a refund. It’s a crucial compliance requirement and must be submitted digitally through MTD-compatible software.

Example: If a business sells £50,000 worth of goods and pays £30,000 on business-related purchases (both VAT inclusive), the VAT return reconciles these figures to calculate the net amount due to or from HMRC.

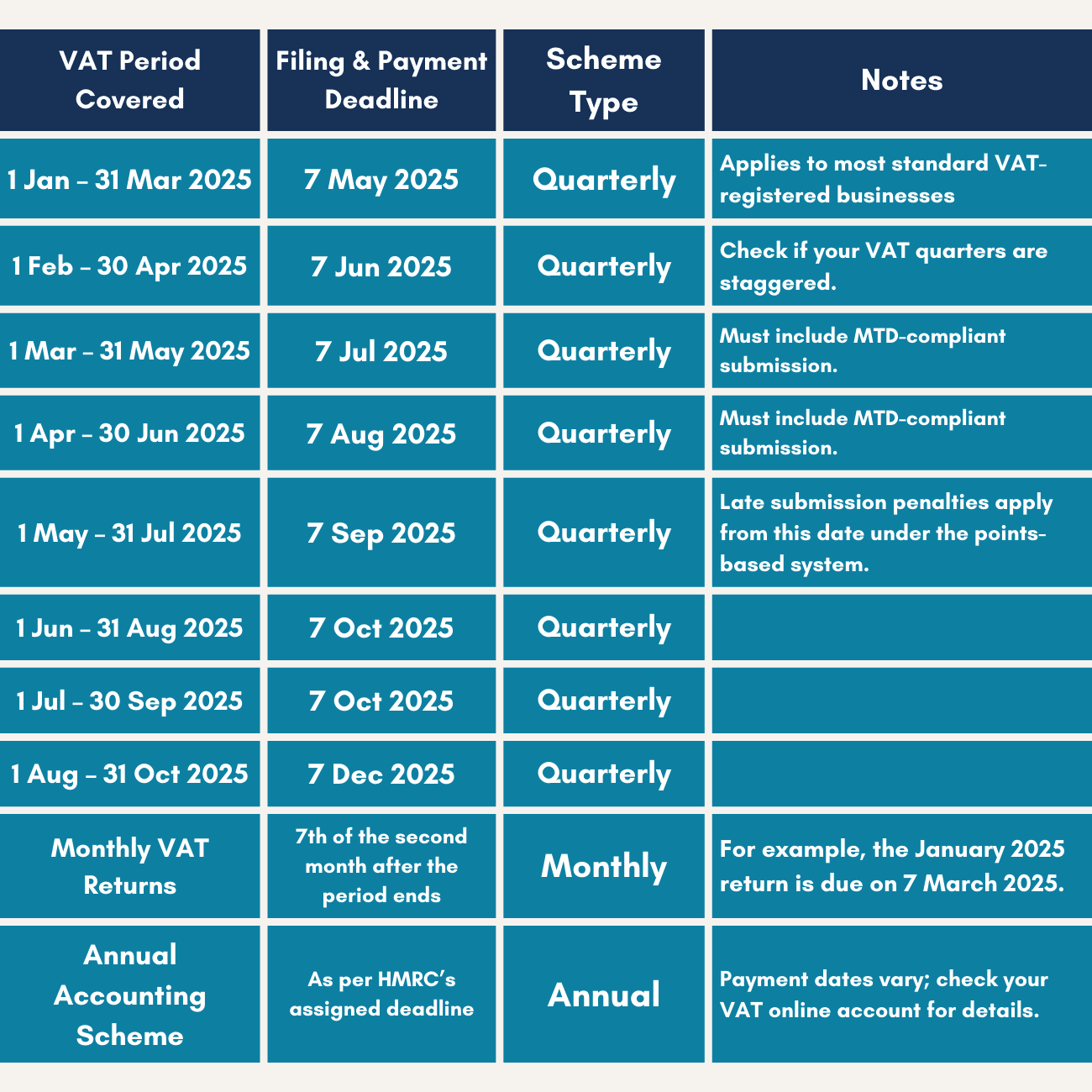

The most important step for any VAT-registered business is knowing your VAT return deadlines. Most businesses submit quarterly VAT returns, but some opt for monthly or annual schemes.

One calendar month and seven days following the conclusion of your accounting period is your deadline. For instance, your return and payment must be turned in by May 7, 2025, if your VAT quarter ends on March 31, 2025.

This is common for businesses that regularly reclaim VAT. Returns are due after one month and seven days after the end of each month.

Annual filing is due two months after your chosen year-end, but you make advance payments throughout the year.

A missed deadline can trigger both financial penalties and reputational damage with HMRC, especially now that penalties are stricter.

Why this matters: For accountants managing dozens of client VAT returns, missing even a single one can trigger penalties under HMRC’s points-based system. Knowing these dates in advance helps you build a compliant, repeatable VAT filing calendar.

In 2023, HMRC introduced a new points-based penalty system to encourage consistent, on-time VAT compliance. Under this system, businesses accumulate penalty points for each missed submission, and once they reach a threshold (e.g., 4 points for quarterly filers), they receive a £200 penalty. The points expire after a “clean” 24-month period, but reaching the threshold resets the clock.

1 point per missed VAT return filing date

£200 penalty when threshold is reached (4 points for quarterly submissions).

More points = higher risk of recurring penalties.

No penalty if paid within 15 days of the VAT due date (but interest is still charged).

On day 16, a 2% penalty applies on the outstanding VAT.

On day 31, another 2% is charged.

From day 31 onward, a daily penalty accrues at 4% per annum until the balance is cleared.

Real-world example: If your client’s VAT payment of £8,000 is 20 days late, they could face a 2% (£160) penalty—plus interest—if not addressed within the 15-day window.

Submitting VAT returns correctly isn’t just about meeting deadlines—it’s about maintaining audit-ready records, following HMRC’s Making Tax Digital (MTD) rules, and preventing penalties due to incorrect or incomplete information. Here’s how UK accounting firms can make VAT return submissions smooth, accurate, and compliant every time.

First, identify what type of VAT scheme your client is on. Most small to medium-sized UK businesses are on the standard VAT scheme, where VAT returns are filed quarterly. However, some businesses may opt for:

Monthly returns – Common for businesses expecting regular VAT refunds (e.g. exporters).

Annual accounting scheme – Fewer returns, but advance payments required.

Flat Rate Scheme (FRS) – Simplified accounting, but still requires quarterly filing.

Why it matters: Filing the wrong type of return or on the wrong schedule can lead to penalties or HMRC queries. Confirm the correct return type and period before preparing the data.

Under Making Tax Digital (MTD), all VAT-registered businesses should keep your digital records and use MTD-compatible software to submit their VAT returns. This means:

Recording all sales and purchases with the correct VAT rate.

Tracking input and output VAT separately.

Ensuring digital links between systems (e.g., sales software and accounting software) to comply with MTD rules.

Tip for firms: Use software like Xero, QuickBooks, Sage, or FreeAgent for seamless record-keeping. Avoid Excel spreadsheets unless they’re digitally linked via bridging software.

Before preparing your return, you have to reconcile the VAT records with the bank and source documents. Now check for:

Missing or duplicate invoices

Unclaimed input VAT (especially for high-value expenses or imports)

Errors in VAT rates (e.g., zero-rated or exempt items wrongly marked)

Example: A supplier invoice marked with the 20% VAT rate when it should be 5% (e.g., energy bills) could overstate the VAT reclaim, triggering HMRC scrutiny.

Once reconciliations are complete:

Generate the VAT return within the chosen software.

Review totals for:

Box 1: Output VAT on sales

Box 4: Input VAT on purchases

Box 5: Net VAT is to be paid or reclaimed

Double-check Box 6 and 7 (total sales and purchases excluding VAT) for obvious mismatches.

Tip: Always save a draft of the return and have a second person review it before submission.

After reviewing and confirming the figures:

Connect the software to HMRC’s MTD portal using the client’s Government Gateway credentials.

Submit the return directly from the software (no manual entry).

Download or save the HMRC confirmation receipt as proof of submission.

Pro Tip: Set up a submission checklist or SOP your team follows for every VAT return. This reduces reliance on memory and prevents skipped steps.

Once the return is submitted, make sure the VAT payment is scheduled correctly. The filing and payment deadlines are the same (usually 1 month + 7 days after the VAT period ends). You can pay via:

Direct Debit – Set up in advance. HMRC automatically collects payments on time.

Faster Payments / BACS / CHAPS – Ideal for same-day or scheduled transfers.

Debit/Credit Card – Less common but usable via HMRC’s online payment portal.

Reminder: The payment must clear into HMRC’s account by the deadline, not just be initiated. Late payments = penalties and interest.

HMRC requires businesses to keep all VAT-related records for at least 6 years, including:

Sales and purchase invoices

VAT calculations

Submission receipts

Digital copies of returns

For accounting firms, storing these digitally in the cloud (e.g., via Dext, Hubdoc, or your bookkeeping software) ensures compliance and easy retrieval during audits.

Is the VAT Submission Deadline the Same as the VAT Payment Deadline?

While both the VAT submission deadline and VAT payment deadlines fall on the same day (1 month + 7 days after the VAT period ends), the payment method you choose can affect the actual settlement date.

|

Payment Debit |

Consideration |

|

Direct Debit |

Automatically debited 3–5 working days after the due date. Must be set up in advance. |

|

Bank Transfer (Faster Payments) |

Must reach HMRC by the deadline date. Allow time for clearance |

|

BACS or CHAPS |

Schedule early to avoid weekend/holiday delays. |

|

Debit/Credit Card |

Immediate, but daily limits and transaction blocks may apply. |

Takeaway for firms: Encourage clients to use Direct Debit, which offers a small grace period and reduces the chance of human error.

This year sees several updates affecting both compliance requirements and digital reporting processes:

Making Tax Digital (MTD) Full Enforcement: All VAT-registered businesses, including those voluntarily registered, must now keep digital records and submit returns using MTD-compatible software.

Revised VAT Penalty System: Late VAT payment or VAT return filing now follows a points-based system, with interest charged on overdue amounts.

Threshold Changes for Cross-Border Sales: New EU VAT rules affect UK sellers dispatching goods to EU customers, impacting the way you report and pay VAT.

Sector-Specific Adjustments: The rate categories have been lowered for a few industries, including renewable energy and hospitality.

These modifications go beyond simple administrative adjustments; in order to guarantee complete compliance, companies must reassess their accounting, filing, and record-keeping procedures.

With multiple VAT return deadlines in 2025, changing digital compliance requirements, and increasing HMRC scrutiny, getting VAT right is more important than ever, especially for accounting firms managing multiple clients. Staying ahead means more than just submitting returns on time; it means having the right systems, software, and internal controls in place.

Whether you're filing your return monthly, quarterly, or annually, but you have to keep accurate records, timely reconciliations, and MTD-compliant processes. By following the steps outlined above, your firm can reduce risk, enhance client trust, and ensure seamless VAT submissions every time.

Need Help Managing VAT Returns for Multiple Clients?

At Aone Outsourcing Solutions, we specialise in helping UK accounting firms streamline and scale their VAT return processes—from data collection to digital submissions. Whether you're short-staffed or just need help managing high volumes during peak periods, our experienced team ensures your clients never miss a deadline.

Reach out today to discover how we can support your firm with accurate, on-time VAT compliance in 2025 and beyond.

1. When is the VAT return deadline in the UK?

The VAT return deadline is one month, seven days when your accounting period ends. For example, if your VAT period is ending on 31 March 2025, then the return as well as payment will be submitted on 7 May 2025.

2. Can I submit my VAT return on the 7th of the month?

Yes, you can submit your VAT return on the 7th day, which is normally the deadline. However, to avoid last-minute issues or delays in payment processing, it's recommended to file at least a few days in advance.

3. What happens if I miss the VAT return deadline?

Missing the VAT return deadline may result in:

Late payment penalties

Daily interest charges

Points under the HMRC’s penalty points system (which can lead to further fines if repeated)

4. Is VAT return submission mandatory under Making Tax Digital (MTD)?

Yes. If you're VAT-registered and your taxable turnover is above the threshold (£90,000 in 2025), you must submit VAT returns digitally via MTD-compatible software.

5. What penalties apply for late VAT payments in 2025?

As per HMRC’s updated rules:

Day 1–15: No penalty, but interest is charged.

Day 16: 2% of VAT owed.

Day 31: An additional 2% of the remaining unpaid VAT.

From Day 31 onward: A daily penalty of 4% per annum until full payment.

6. Can HMRC offer a payment plan for overdue VAT?

Yes, HMRC can offer a Time to Pay (TTP) arrangement if your client is struggling to pay. This allows the VAT liability to be paid in instalments. You must contact HMRC before the payment becomes overdue to request this.