GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

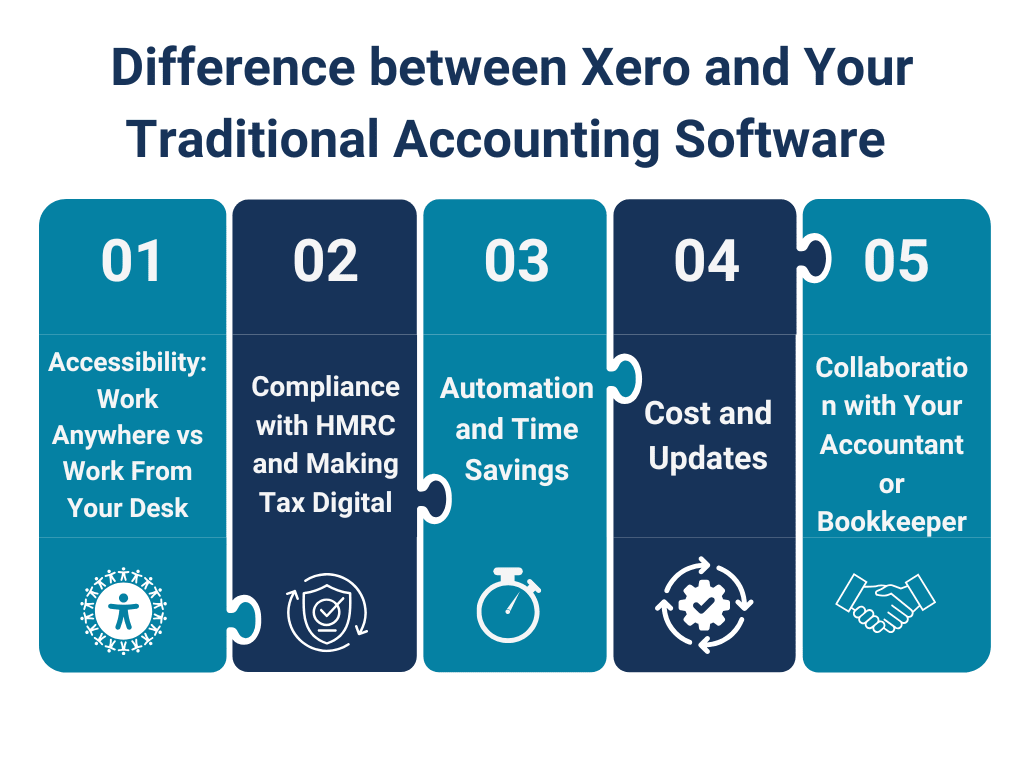

Managing business finances is not just about balancing the books, it’s about doing it faster, smarter, and with complete accuracy. That’s where Xero, one of the world’s leading cloud-based accounting platforms, has become a game-changer for businesses of all sizes. With real-time data, automated invoicing, and seamless collaboration, Xero helps business owners to manage their finances anytime, anywhere.

On one side, you have Xero, sleek, modern, cloud-powered, and designed with automation and real-time access in mind. On the other, you have traditional accounting systems, the tried-and-tested software that has been around for decades, offering familiarity but often less flexibility.

The right choice will depend on your business goals, your compliance needs (like Making Tax Digital), and how you prefer to manage your financial data. Let’s break it down.

Xero is a cloud accounting software, managing your business finances easier, faster, and more accurate. Unlike traditional accounting tools that need to be installed on one computer, Xero works entirely online. This means you can access your books accounts anytime, anywhere whether you’re in the office, at home, or halfway across the world, using your computer, tablet, or phone.

The platform is built to handle everything from invoicing and payroll to expense tracking and bank reconciliation in one place. Because it’s cloud-based, all your financial data is updated in real time. If your accountant makes a change, you’ll see it instantly, no messy file transfers or outdated reports.

Xero also integrates with hundreds of business apps, like payment gateways, inventory systems, and CRM tools—so you can connect all your business processes into one smooth workflow. Plus, with bank feeds, your transactions flow directly into the system every day, saving you hours of manual data entry.

Xero Advantage:

Xero operates entirely in the cloud, meaning you can log in from anywhere, whether you’re in your London office, working from home in Manchester, or sipping a flat white in a café in Edinburgh. All you need is an internet connection, and you’ll have real-time access to your business finances.

Cloud storage would also imply automatic backup of data. However, you do not have to be afraid of losing records in case of a computer crash or a crash of your office server.

Traditional Software Limitation:

Traditional accounting software is usually tied to one machine or a local network. This means if you’re not in the office, you can’t easily check invoices, run payroll, or review VAT submissions. Some systems require complicated VPN setups for remote access, which can be slow and unreliable.

|

Pro Tip: If your business often works with remote accountants or needs to share data across multiple locations, Xero’s anywhere-access approach will save you hours of frustration. |

Xero Advantage:

Making Tax Digital was introduced in the UK in April 2022 and most businesses registered to account to VAT are now required to keep digital records and file an online VAT return. Xero is already MTD-ready and is able to submit VAT returns to HMRC on an automatic basis without a manual upload process.

It also makes sure that all data on transactions is kept in a compliant format, which minimizes the possibility of committing errors and penalties. When it comes to paying employees, Xero connects with HMRC's Real Time Information service to submit PAYE figures, meaning you can keep up with the rules on employment tax.

Traditional Software Limitation:

Many older desktop systems are not MTD-compliant without expensive upgrades or add-ons. If you stick with traditional software that isn’t updated regularly, you might end up doing more manual work and risk HMRC penalties for non-compliance.

|

Pro Tip: If you haven’t yet made the switch to an MTD-compliant system, upgrading to Xero now could save you costly headaches later. |

Xero Advantage:

Almost all the day-to-day accounting jobs can be automated using Xero such as the ability to import accounts of a bank, reconcile payments, send invoice reminders and create financial reports. For example:

Automatic bank feeds retrieve the transactions of your account without tampering and can be reconciled.

Repeated invoices can be dispatched automatically.

Expense claims could be handled easily, as it is just required to post a picture of the receipt.

Such automation is particularly useful when the small business owner will not be able to enter data on a daily basis.

Traditional Software Limitation:

Some desktop systems provide automation but it is usually very limited and needs extra preparation or paid modules. Most of the jobs, including importing bank transactions, require downloading and uploading CSV files which are time-consuming and difficult to avoid human errors in them.

|

Pro Tip: Does having your bookkeeping just doing itself behind the scenes subtlely as you concentrate on running your company sound good? Xero automated bookkeeping will be magical. |

Xero Advantage:

Xero operates on a subscription model, meaning you pay a monthly fee and get free updates automatically. There’s no need to purchase expensive upgrades or worry about your software becoming outdated.

Because it’s cloud-based, Xero’s new features, like improved reporting tools or updated tax compliance are rolled out instantly without installation hassles.

Traditional Software Limitation:

With traditional systems, you might have to buy a new version every few years to stay compliant with changing UK tax laws. Updates often involve installing patches or replacing the software entirely, which can be costly and disruptive.

|

Pro Tip: Calculate your total cost of ownership over five years. You may find that Xero’s subscription ends up cheaper than repeatedly upgrading traditional software. |

Xero Advantage:

Xero makes it easy for your accountant or bookkeeper to log in and work on your accounts in real time, without needing to send large files back and forth. They can quickly fix errors, prepare VAT returns, and run year-end accounts without waiting for you to send over paperwork.

Traditional Software Limitation:

With older systems, collaboration often involves emailing backups or transferring data files via USB, both of which are slow and carry security risks.

|

Pro Tip: If you value instant, secure collaboration with your accountant, Xero’s shared-access model will feel like a breath of fresh air. |

If your UK business needs flexibility, HMRC compliance, automation, and real-time collaboration, Xero is a clear winner. However, if your operations are entirely office-based, you have no plans to adopt MTD, and you prefer a one-time software purchase over a subscription, traditional software might still work for you.

At the end of the day, your accounting system should save you time, keep you compliant, and give you clarity over your finances. Whether you are filing VAT, managing PAYE, or chasing invoices, the right tool will make the job smoother.

This is exactly where Aone Outsourcing Solutions, with our extensive expertise, steps in. As specialists in outsourced accounting and bookkeeping services, we help you unlock Xero’s full potentialintegrating it flawlessly into your business processes, customising it to your unique needs, and ensuring your financial operations run like clockwork. Think of us as your behind-the-scenes accounting tech team, making sure your Xero does the heavy lifting while you focus on your business.

Tailored Setup & Migration – We handle everything from configuring your Xero account to securely migrating your existing accounting data from spreadsheets or other accounting software, ensuring no information is lost or duplicated.

Process Optimisation – We don’t just integrate; we analyse your workflows and customise Xero features so they work for your specific industry and operational style.

Add-on App Integration – Whether it’s payroll, inventory management, or payment gateways, we connect Xero with the right third-party apps for a smooth, automated system.

Error-Free Bookkeeping & Reconciliation – Our experts ensure that your bank feeds, invoices, and reconciliations are 100% accurate, eliminating costly accounting mistakes.

Training & Support for Your Team – We provide step-by-step guidance so your staff can confidently use Xero and make the most of its automation and reporting features.

Compliance-Ready Reporting – From BAS/GST returns in Australia to VAT submissions in the UK or tax compliance in the US/Canada, we set up Xero reporting to meet local regulatory standards.

24/7 Expert Assistance – Our global support team is available to solve your issues, answer questions, and keep your accounting running without delays.

Ready to simplify your accounting with Xero? Let Aone Outsourcing Solutions handle the setup, integration, and ongoing support—so you can focus on growing your business.

Q1. What is Xero, and how can i use it for my business?

Xero is a leading cloud-based accounting software designed for small and medium-sized businesses. It allows you to manage invoices, bank reconciliations, payroll, expense claims, and reporting in real-time from anywhere. It’s known for its ease of use, automation features, and ability to integrate with over 1,000 other business apps.

Outsourcing your Xero bookkeeping to experts like Aone Outsourcing Solutions means you get accurate, up-to-date financial records without having to hire full-time staff. It reduces costs, ensures compliance, and allows you to focus on your business while we handle your accounting books.

Yes. We provide complete migration services, including data cleanup, chart of accounts setup, importing historical data, and training your team to use Xero effectively. We ensure there’s no disruption to your business during the switch.

Absolutely. Xero uses bank-grade encryption, two-factor authentication, and secure data centres to protect your financial information. Additionally, when you work with Aone Outsourcing Solutions, we implement strict data security policy to ensure your information remains confidential.

Xero offers tiered pricing based on features, starting from basic plans for freelancers to advanced packages for growing businesses. While the cost depends on your needs, most businesses find that the automation, time savings, and reduced errors easily outweigh the subscription fee — especially when paired with professional management.