GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

The end of the financial year can feel like a storm approaching—deadlines, reconciliations, final adjustments, and mountains of paperwork all coming at once. For many accountants and business owners, this time is synonymous with late nights and high stress.

But it doesn’t have to be this way; with the right accounting tools, processes, and support systems in place, year-end accounting can become a streamlined, stress-free task. In fact, it can be a valuable opportunity to evaluate your company’s performance, correct any issues, and set a strong foundation for the next financial year.

In this blog, we’ll break down everything you need to know about simplifying year-end accounting through outsourcing, cloud-based tools, and best practices. Whether you manage a single business or multiple client accounts, these insights will help you wrap up the year accurately, efficiently, and without the usual chaos.

Year-end accounting is the process of reviewing, closing, and finalising all financial records of a business at the end of the year. It involves ensuring that every income, expense, asset, liability, and equity account is accurately reconciled and properly documented.

The goal is to produce a clear and complete set of financial statementthat s typically includea s balance sheet report, profit and loss statement, and cash flow report that reflect the business’s true financial performance and position.

Without accurate year-end accounting, businesses risk making poor decisions based on incomplete data, facing compliance penalties, or even triggering audits.

In short, year-end accounting tells the story of your business’s financial year, and it’s vital to get that story right.

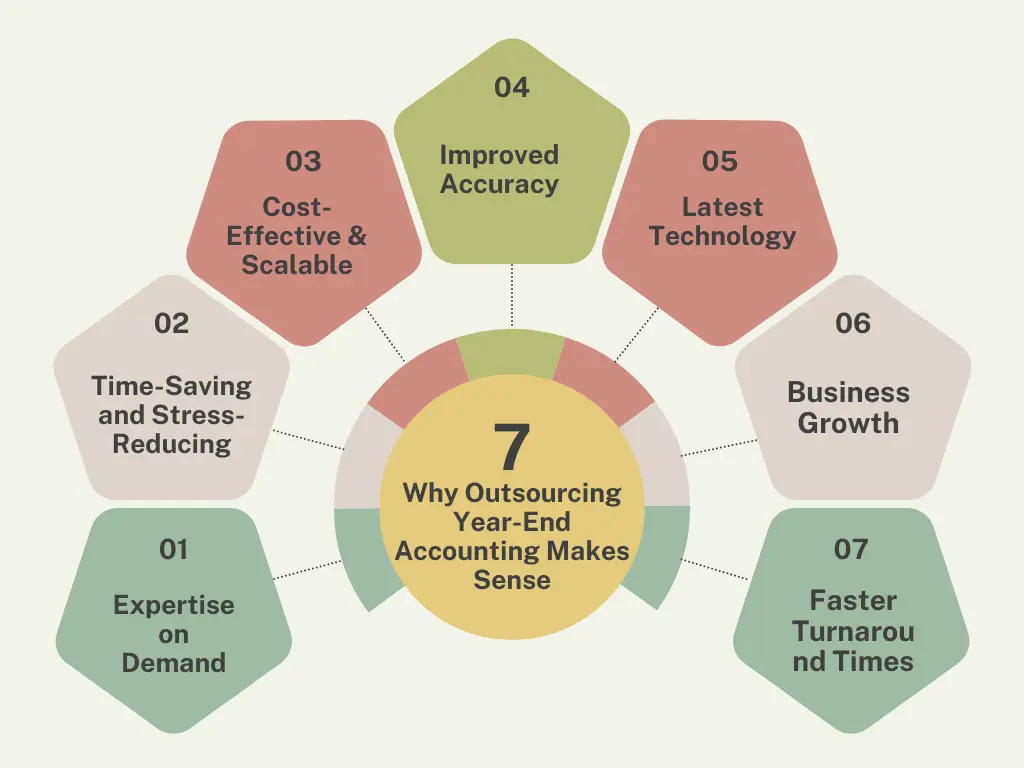

When the financial year comes to a close, many businesses—especially small and mid-sized firms—find themselves scrambling to finalise their accounts. Between collecting documents, reconciling reports, and meeting tax deadlines, the workload can feel very challenging. That’s where outsourcing year-end accounting becomes not only helpful but also important.

Here’s why smart businesses are turning to outsourcing partners to handle year-end accounting tasks:

Outsourcing has a team of qualified accountants who specialise in year-end reporting. These professionals are familiar with local tax laws, compliance requirements, and reporting standards. Whether it’s UK GAAP, IFRS, or Australian Tax Office (ATO) guidelines, they know what to do—and how to do it right the first time.

|

Benefit: You don’t need to train or supervise anyone. Just hand over your data, and let experienced professionals handle the rest. |

Closing the books takes time—especially if your internal team is already handling day-to-day operations. Outsourcing allows you to offload repetitive, time-consuming tasks like reconciliations, adjusting entries, and working paper preparation so you can focus on strategic planning, client management, or business development.

|

Benefit: Meet deadlines faster with less stress on your in-house staff. |

Hiring seasonal or full-time staff to manage year-end work can be expensive. With outsourcing, you pay only for what you need—no employee benefits, training costs, or long-term contracts. As your workload increases, your outsourcing partner can scale resources up or down instantly.

|

Benefit: You gain flexibility and control over costs while maintaining high-quality output. |

Mistakes in year-end reporting can lead to serious consequences—tax penalties, cash flow errors, or even audits. Outsourcing services follow strict quality control protocols and use automated tools to ensure that every entry is correct, every statement reconciled, and every schedule backed by documentation.

|

Benefit: You can get more accurate financial reports with errors and so that compliances can be reduced. |

Many outsourcing providers use cloud-based accounting software that allow for real-time collaboration and secure file sharing. You can monitor progress, provide feedback, and access your year-end reports from anywhere.

|

Benefit: You will get streamlined workflows, transparency, and paperless documentation. |

With the operational workload of year-end accounting, your team can focus on: growth, planning, and informed business decisions. By outsourcing the back-end tasks, you free up internal resources to get the business forward.

|

Benefit: You turn year-end accounting from a burden into a business advantage. |

Outsourcing firms often work across time zones and offer 24/7 support. While your team sleeps, your outsourced team works. This leads to faster completion of reports, reconciliations, and final accounts—helping you close the books on time, every time.

|

Benefit: Beat deadlines with minimal delays and no last-minute rush. |

Outsourcing your year-end accounting can give advantages for your business—accuracy, cost-efficiency, faster turnaround times, and reduced compliance risk. But to truly maximise the value of this partnership, you need more than just a hand-off approach. These actionable, expert-backed tips will help you get the most out of your outsourcing relationship as the financial year wraps up.

Not all outsourcing providers are created equal. To achieve the best results, choose a partner with direct experience in your industry and a solid understanding of your local accounting standards, tax compliance requirements, and regulatory environment. For instance, businesses in the UK may need support with HMRC guidelines and VAT filings, while Australian businesses may require help with BAS and ATO lodgments.

Why it matters: A specialized outsourcing partner doesn’t just process numbers—they bring industry intelligence, compliance assurance, and operational efficiency to the table. This reduces the costly mistakes or delays and ensures that your reports are audit-ready and compliant from day one.

One of the biggest mistakes companies make is waiting until the last minute to loop in their outsourcing provider. Year-end processes are complex and involve multiple moving parts financial reconciliations, tax adjustments, depreciation schedules, payroll summaries, and more.

Why it matters: Early engagement helps reduce last-minute stress and bottlenecks. Regular communication throughout the quarter ensures any issues are identified and resolved promptly. You stay in control of your reporting schedule and minimize the risk of compliance penalties or missed lodgments.

Outsourcing works best when expectations are clearly defined from the outset. Lay out detailed timelines, required deliverables, preferred formats for documentation, approval workflows, and points of contact for different tasks. This clarity is important for outsourced team, but also for your in-house staff who may need to support or review submissions.

Why it matters: When everyone knows exactly what’s expected and when, there’s less room for errors or miscommunication. Clear deliverables keep the project moving smoothly, ensure accountability, and allow you to spot and fix any issues before they escalate.

Sensitive financial data is constantly being exchanged during the year-end process—bank statements, payroll records, tax filings, and more. This makes data security non-negotiable. Make sure you’re using encrypted platforms like Google Workspace, Microsoft SharePoint, or dedicated accounting portals for document exchange. Sign NDAs with your outsourcing partner, limit data access based on roles, and use two-factor authentication whenever possible.

Why it matters: Robust data protection protocols safeguard your company against cyber threats, internal data leaks, and non-compliance with privacy regulations like GDPR or PIPEDA. It also builds trust with your outsourcing partner and internal stakeholders alike.

Disconnected systems are one of the biggest time-wasters during year-end. When your internal accounting software, payroll platform, and document tools don’t sync with your outsourcing partner’s systems, collaboration slows down and mistakes creep in. Instead, aim to integrate your cloud-based tools—like QuickBooks, Xero, Dext, Hubdoc, Gusto, or Slack—for seamless file sharing and real-time updates.

Why it matters: Integration not only automates repetitive tasks but also ensures that everyone—whether in-house or offshore—is working with the latest, most accurate data. This level of real-time visibility reduces manual back-and-forth and speeds up your financial close process dramatically.

Year-end accounting doesn't begin in December—it’s the cumulative result of 12 months of accurate, timely bookkeeping. If your records are a mess, even the best outsourcing team will struggle to produce accurate reports quickly. You have to reconcile your accounts regularly, maintain clean ledgers, store receipts digitally, and resolve discrepancies monthly.

Why it matters: A strong year-round bookkeeping process sets the stage for a smooth, efficient year-end. Clean records mean fewer adjustments, faster turnaround, and accurate tax filings that can stand up to audits without extra rework or last-minute stress.

Outsourcing doesn’t mean offloading responsibilities entirely. Your internal and external teams should work together as one cohesive unit. Encourage regular check-ins between your in-house finance staff and the outsourced team. Assign clear roles, designate a main point of contact, and ensure your team knows when and how to escalate questions or concerns.

Why it matters: Strong collaboration builds trust, eliminates confusion, and helps ensure that nothing slips through the cracks. When your internal and outsourced teams communicate effectively, the entire year-end process becomes smoother, faster, and more reliable—leading to better outcomes for your business.

Year-end accounting doesn’t have to be a scramble. With the right outsourcing strategies, tools, and expert support, you can turn a typically stressful period into a streamlined, insightful, and even strategic part of your business planning. By choosing the right partner, staying organized, and fostering strong communication, your year-end close can deliver more than just compliance—it can drive clarity, confidence, and growth.

At Aone Outsourcing Solutions, we specialise in helping businesses across the UK, Australia, Canada, and the USA navigate their year-end accounting with ease. Whether you need catch-up bookkeeping, tax preparation, reconciliations, or full financial statement support, our team is here to deliver accurate, compliant, and timely results—so you can focus on what’s next for your business.

Let’s make your year-end stress-free and successful—together.