GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Have you ever been stressed about meeting HMRC tax deadlines or checking calculations at the last moment? You are not alone. The process of filing tax returns in the UK has become increasingly complex, particularly for businesses navigating the evolving tax payment requirements, tax codes, and compliance demands.

Now, no matter whether you are a small business owner, a growing startup, or a well-established firm, the workload of doing your tax return yourself can quickly become burdensome. As each new financial year closes, businesses will need to contend with the challenges of interpreting changing laws, preparing accurate records, and filing them with HMRC in a timely manner. One wrong or late action may include fines, an audit, and a damaged reputation.

Considering these factors, it is no wonder that more and more companies are now opting to engage the services of tax return specialists who can help them comply and ensure precision. The benefit of making the move as a strategy is that organisations can minimise stress, costly errors, and concentrate more on growth, rather than paperwork. In this blog, we will examine why tax returns outsourcing is not only a trend but a reality, driven by more prudent financial management among UK-based businesses within the country.

Over the past couple of years, a significant shift has also been observed in the way UK businesses manage their taxes. Many firms, both large and small, are considering hiring external professionals to handle their tax preparation services. Why? Since conducting tax management internally has long ceased to be a daily administrative task, it requires thorough study, mastery of accuracy, and responsiveness.

Increasing Pressure of UK Tax Compliance:

HMRC regulates the tax environment in the UK and regularly updates tax policies, the filing process, and deadlines. When considering the companies that have already been adapting to inflation, payroll expenses, and the shift towards a digital environment, it is another level of burdens on top of ensuring tax compliance. This increased burden has led to tax outsourcing being the model of choice for saving time and reducing stress.

Small Businesses are The Most Affected:

Smaller businesses have often lacked the financial stability or necessary human resources to engage in complex tax affairs. SMEs have limited resources that need to be applied in various functions, as opposed to large firms, which have tax teams at their disposal. This exposes them to the susceptibility of errors and late filings. Firms that outsource tax return services will avoid inaccuracies since they will not be forced to hire full-time tax consultants, hence saving costs.

Demand Boom in the Special Tax Services:

The upsurge in the need for high accuracy, affordability, and swift turnaround has seen more organisations resort to the services of firms offering specialised outsourced tax preparation services. They provide a high level of expertise, leverage sophisticated tools, and stay up to date with UK tax legislation; hence, they are an essential partner to handle tax season. Consequently, outsourcing has become a trending business practice, and companies such as Aone Outsourcing are leading the revolution.

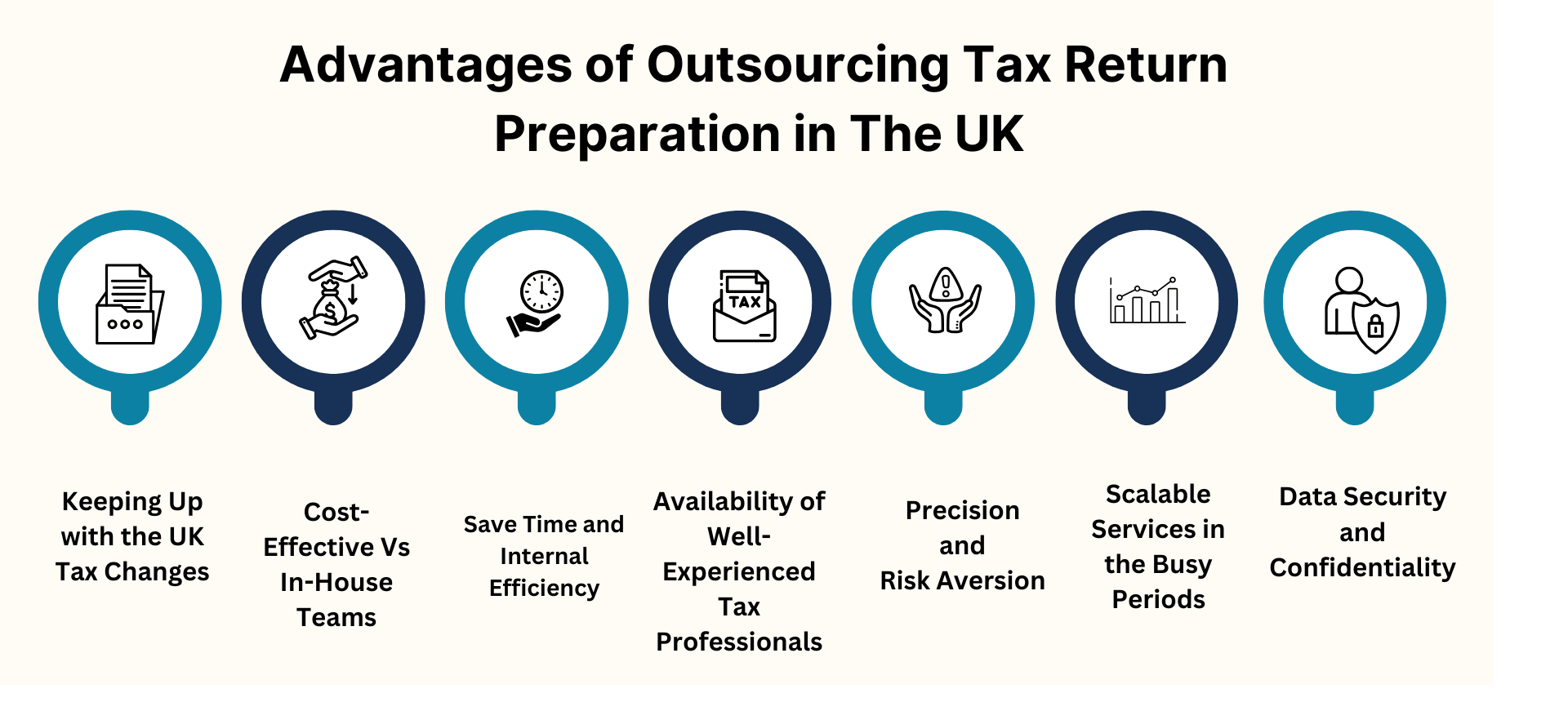

In the modern, hectic business world, both efficiency and accuracy are highly regarded. The advantage of outsourcing tax preparation enables UK businesses to enjoy several benefits beyond time savings. Find out what makes tax return outsourcing service a strategic advantage. The following are some of the reasons why an elite outsourcing service will come in as an advantage to your company:

The tax environment in the UK is constantly evolving. HMRC changes rules, thresholds, and filing processes on an annual basis, so in-house teams must work diligently to stay entirely up to date. A wrong number on your salary slips or neglecting avoidable deductions may mean audits or costly fines, even when it is pretty minor.

Income tax outsourcing also equips firms with industry experts who stay up-to-date with existing tax laws and the forms required for tax submissions. These individuals can ensure that returns are made correctly, entirely, and promptly, thereby ensuring your company does not operate at the end of the totem pole, whether it involves taking risks due to compliance or facing legal problems. Peace of mind is not the only added value of outsourcing, but the reputation of financial responsibility and transparency is also created.

Deploying an in-house tax department requires managing significant costs, including wages, training, perks, and a technological framework. These costs are not justifiable to many SMEs and larger companies, as tax activities are seasonal.

Conversely, tax outsourcing offers flexible services tailored to your business's specific requirements. You only pay when you need us, whether it's for quarterly help, preparing tax returns at the end of the year, or ongoing assistance with compliance issues. The cost of outsource tax preparation services is significantly lower than the cost of employing the same number of employees on a full-time basis. Besides, you stop overheads without reducing the quality or accuracy.

Preparing taxes can be time-consuming and stressful for the brain. It takes time and concentration to manage business activities, such as collating receipts and documents, calculating numbers, and ensuring they meet HMRC's criteria. Small teams that have to multitask and must also engage in decision-making and strategic planning can be bogged down at this time cost.

Outsourcing your tax returns allows you to rechannel your in-house personnel to activities that have a high impact, such as customer engagement, operational refinement, and business growth. Outsourcing saves precious time, reduces interruptions and provides room to think smarter about money and track as well.

The tax regulations in the UK are complex, and no in-house accountant can claim to have perfect knowledge and understanding of all realms of tax law. Therein lies the glory of outsourcing. Tax outsourcing services enable you to access teams of relatively experienced specialists who handle tax returns across various industries and business scales.

These professionals understand the best ways to capitalise on deductions, utilise applicable exemptions, and avoid expensive mistakes. They are also knowledgeable in HMRC systems and digital platforms that make the submission process easier and the turnaround time quicker. The advantage of having dedicated specialists go through and prepare their tax filing puts your organisation a step ahead in business because they take more care of your finances with knowledge and expertise.

Nobody can afford to be inaccurate when preparing tax returns. Any self-prepared tax return that contains inaccuracies can lead to an audit by HMRC, resulting in a delay in refunds or even fees being charged due to erroneous data, such as miscalculations, misclassifications, or incorrect data input. The typical standard errors, which include failing to deduct expenses incurred, overreporting revenues, or even selecting the wrong tax code, are also more prevalent than imagined, especially when internal taxation expertise is not available within the business.

Outsourcing tax returns is one way to significantly reduce the chances of errors significantly. Outsourcing providers utilise sophisticated tax software programs, standard tax operations, and multiple levels of checks to ensure that each tax return is accurate and undergoes an audit. The degree of accuracy it allows not only protects your business against compliance problems, but also ensures that you are taking full advantage of every opportunity to pay the legally available tax to the UK.

The workload characteristic of tax season is usually quite dramatic. As a result, internal teams often find themselves overwhelmed, particularly when they are already dealing with the normal flow of financial operations. Impatience may result in hiring new workers on a contractual basis or straining the current employees, which can lead to careless work, stress, and lower productivity.

Outsourcing is a scalable solution that adapts to your business needs. Whether it's preparing annual tax returns, making last-minute corrections, or handling multiple entities, outsource tax preparation services provides you with immediate access to additional workforce, which can be too time-consuming and expensive to recruit.

This scalability ensures that deadlines are effectively met, even during peak times, at the expense of quality and accuracy. Outsourcing companies, such as Aone Outsourcing, have been developed to consistently target high-volume activity in a short timeframe, providing your organisation with the agility to take on tax-intensive seasons.

The privacy and protection of financial data should involve the highest levels of security. Failure to adhere to GDPR rules, even in handling sensitive client and internal information, is also a crime for UK businesses. Security breaches on data may result in regulatory implications and tarnish the brand image.

One of the effective data security strategies adopted by reputable tax outsourcing service providers is file encryption, encrypted files sent via email, client databases, authorised access, and non-disclosure contracts. Such protocols can ensure that your information is secure at every stage of tax preparation.

Aone Outsourcing, in its turn, works under high levels of confidentiality and fully adheres to GDPR and global data protection regulations. Outsourcing partners, such as Aone, are confident and trustworthy, considering their history of serving international clients with high levels of security and confidentiality. You can leave your tax concerns to these trusted hands.

When outsourcing tax returns, it is crucial to engage a reputable and well-established company. Aone Outsourcing has gained the trust of UK firms and accounting firms by providing quality and efficient services. The firm prepares taxes efficiently and securely, fully meeting the needs of various firms.

Experience in UK Tax Return Preparation

A one Outsourcing has been in the tax outsourcing service industry for more than ten years, with extensive experience in processing thousands of tax returns across various sectors and entities. Whether we are a sole trader or a large corporation, we have a team that is familiar with the UK tax system and dedicated to ensuring every tax return meets HMRC's standards.

New Technology and Trained Experts

We are united with professional human intelligence and innovative technology. The chartered accountants, tax consultancy, and compliance consultancy desks in our agency utilise top-of-the-range taxation software, digital safe work, and multi-tiered pyramid systems to ensure accuracy. This will guarantee that all clients enjoy not only the professional perspective but also automation-aided productivity.

Specialised Services to UK Businesses and Accountants

In Aone, we realise that there are no two similar clients. Our tax filing outsourcing services are entirely customizable, offering tax return solutions tailored to the specific needs of SMEs, startups, and accounting firms. Our customers benefit from comprehensive tax preparation services and seasonal solutions when they hire our versatile team, which works within their budget and meets deadlines.

|

What Our Client Says: The tax services provided by Aone Outsourcing have changed our working routine. They are accurate, responsive, and up to the task; this has allowed our staff to concentrate on business development activities. We fully confide in them regarding our tax compliance.”

|

Final Thoughts!

The business world has become increasingly fast-paced, posing a greater need than ever to prepare tax returns as efficiently and accurately as possible. When businesses outsource tax preparation in the UK, they can obtain professional assistance, reduce operational costs, enhance compliance, and reclaim lost time.

Outsourcing tax returns is not only a convenience but also a tactical step towards proactive financial management. It ensures that your business does not have to worry about regulatory requirements, allowing all priorities to concentrate on the most critical objectives.

Want to have a stress-free tax season?

Contact Aone Outsourcing now and enjoy the difference of professional-led, secure and scalable outsourcing Tax preparation services to meet the demands of the UK market.