GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

For many UK business owners, VAT and bookkeeping aren’t just administrative tasks—they’re recurring sources of stress, confusion, and risk. Between Making Tax Digital (MTD) compliance requirements, complex VAT rules, frequent HMRC updates, and the pressure to submit error-free returns on time, it’s no wonder that VAT is one of the most common areas where businesses slip up. Even something as small as a misclassified invoice or a missed deadline can trigger penalties, interest charges, or even a full-blown audit. The truth is, managing bookkeeping and VAT in-house—especially without dedicated expertise—isn’t just time-consuming, it’s risky.

This is where outsourcing bookkeeping and VAT reconciliation becomes more than just a convenience—it becomes a lifeline. By handing off these critical but technical tasks to experienced professionals, businesses can ensure their records are accurate, VAT is reconciled properly, and submissions are made on time through MTD-compliant software. Whether you’re a small retailer, a fast-growing e-commerce brand, or an accounting firm handling multiple clients, VAT compliance outsourcing not only saves time but significantly reduces your exposure to financial penalties and regulatory headaches.

In this blog, we’ll walk through the growing challenges of VAT and MTD compliance in the UK, the hidden dangers of DIY bookkeeping, and how outsourced bookkeeping services can help you stay compliant, confident, and in control.

Before MTD, businesses could get by with spreadsheets and manual entries. But now, HMRC demands digital VAT submissions through MTD-compatible software. Unfortunately, traditional in-house bookkeeping often fails to keep pace due to:

Inconsistent data entry

Delayed reconciliations

Manual VAT calculation errors

Software limitations or outdated systems

Lack of in-house VAT expertise

Even small errors can lead to missed deadlines, non-compliance penalties, and frustrating HMRC audits. And if you're trying to juggle all this on top of running your business? It’s a disaster waiting to happen.

Pro Tip: Don't treat VAT as just another monthly task. With MTD, VAT has become a strategic compliance area—requiring both accuracy and speed.

VAT reconciliation is one of the most important but frequently misunderstood aspects of VAT compliance. In simple terms, it’s the process of cross-verifying the VAT charged on your sales (output VAT) and the VAT paid on your purchases (input VAT) with the values recorded in your accounting software and reported to HMRC.

This reconciliation process ensures that every VAT transaction is properly accounted for, categorised correctly, and submitted accurately. But in practice, VAT reconciliation is time-consuming and highly error-prone especially for businesses with a large volume of transactions or complex VAT scenarios, such as the construction industry (CIS reverse charge), import/export businesses, or companies dealing with partial exemptions. Mistakes such as double-counting invoices, omitting credit notes, using the wrong VAT codes, or entering dates incorrectly can all result in underpayment or overpayment of VAT, triggering unwanted HMRC investigations or fines.

This is where VAT reconciliation outsourcing provides a game-changing advantage. By handing over this critical task to specialists who combine automation, reconciliation tools, and manual review checks, businesses can gain peace of mind that their VAT data is accurate, audit-ready, and MTD-compliant. It eliminates stress, reduces financial risk, and ensures you’re always on the right side of HMRC requirements.

VAT outsourcing means handing over the responsibility of your VAT preparation, filing, and compliance to an external, expert team. Whether it's monthly or quarterly VAT returns, partial exemption calculations, or navigating post-Brexit rules—outsourcing ensures accuracy, HMRC compliance, and peace of mind.

It’s not just about offloading work. It’s about bringing in VAT experts who specialise in:

Automated VAT reconciliation

Real-time error checking

Submission via MTD-compliant software

Industry-specific VAT rules (construction, hospitality, retail etc.)

Brexit-related cross-border VAT changes

Combined with outsourcing bookkeeping, it creates a complete financial system where transactions, reconciliations, and tax returns are aligned—reducing errors and increasing visibility.

VAT reconciliation is the process of ensuring that VAT on sales and purchases matches what is reported to HMRC. It may sound simple, but in practice, it's the most error-prone part of VAT reporting.

Common problems include:

Incorrectly claimed input VAT

Missed VAT on credit notes

Duplicate entries in ledgers

Misclassified transactions

VAT reconciliation outsourcing solves this by bringing automation, AI tools, and trained professionals into the process. Each transaction is reviewed, matched, and coded correctly to make your VAT returns audit-ready.

Did you know? HMRC now uses data analytics to flag VAT mismatches. Inaccurate reconciliations can trigger expensive compliance checks—even if the error was unintentional.

MTD isn’t just about submitting VAT returns, it’s about keeping digital records in real-time. That’s where outsourcing bookkeeping services comes in.

With outsourced bookkeeping, every transaction is:

Categorised and coded correctly

Linked to VAT rules and schemes

Stored digitally in MTD-compliant formats

Updated in real-time on cloud platforms

Your outsourced team ensures that the VAT return is just a click away—because everything’s already reconciled, categorised, and checked. No more panicked end-of-quarter rushes.

Plus, outsourcing gives you access to affordable bookkeeping services using tools like Xero, QuickBooks, Sage, and FreeAgent—all of which integrate seamlessly with MTD.

Almost every business in the UK with turnover above the VAT threshold (£90,000 in 2025) must comply with MTD. But the following types especially benefit from outsourcing:

Small businesses & startups – Lack of in-house finance teams

Construction firms – Complex VAT reverse charges

E-commerce sellers – Cross-border VAT complications

Hospitality & retail – High volume of daily transactions

Accountancy firms – Handling client VAT returns under MTD

VAT compliance outsourcing scales with your business—so whether you're a freelancer, a growing e-commerce brand, or a multi-location franchise, the support remains seamless.

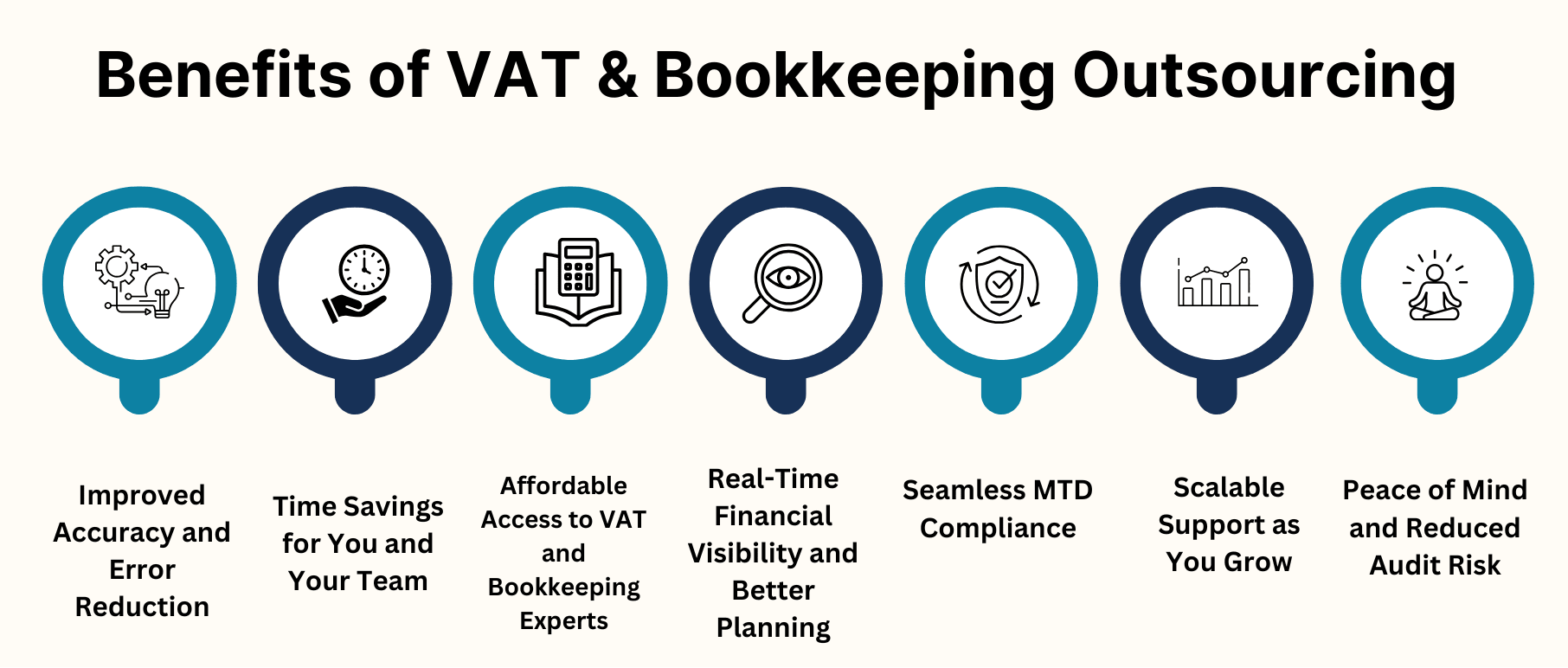

VAT mistakes—like wrong tax codes, duplicate entries, or unclaimed input VAT—can easily slip through when bookkeeping is handled manually or sporadically. With outsourcing, trained professionals handle your books and VAT processes using proven systems and software. This ensures every transaction is entered correctly and reconciled properly, leaving little room for errors. Accurate data means accurate VAT returns—and far fewer compliance risks with HMRC.

When bookkeeping and VAT tasks are outsourced, you immediately gain back valuable hours. No more stressing over spreadsheets, reconciling bank feeds, or scrambling before quarterly VAT deadlines. Your provider keeps everything updated behind the scenes, so you can focus on running your business. It’s a massive time-saver for busy owners, finance managers, or lean teams wearing multiple hats.

Building an in-house finance team is costly—especially if you need VAT specialists. Outsourcing gives you access to experienced professionals at a much lower cost. Whether it’s routine bookkeeping, complex VAT reconciliation, or filing through MTD software, you get expert help without the payroll, software licensing, or HR overhead. It’s smarter, leaner, and scalable for SMEs.

Outsourced bookkeeping gives you access to real-time data via cloud software. You can view up-to-date cash flow, VAT liabilities, and expenses anytime, anywhere. This improves financial planning, tax forecasting, and day-to-day decision-making. Instead of waiting for end-of-quarter reports, you stay in control with full financial visibility at your fingertips.

Making Tax Digital isn’t optional—it’s the law for VAT-registered UK businesses. Outsourcing ensures your records are digital, properly structured, and submitted through MTD-compatible platforms. Your provider handles all updates, reconciliations, and submissions on time. That means no missed deadlines, no last-minute panic, and no risk of HMRC penalties due to non-compliance.

As your business grows, so do your financial responsibilities. More invoices, more transactions, more VAT complexity. An outsourced provider can scale their service to match your growth—without you needing to hire more staff or train internal teams. From startups to multi-location operations, outsourcing grows with you.

Knowing your books and VAT returns are handled by professionals means you can rest easy. Clean, reconciled records lower your chances of being flagged by HMRC. And if you’re ever audited, everything is documented, accurate, and ready. It’s peace of mind every quarter—and long-term protection for your business.

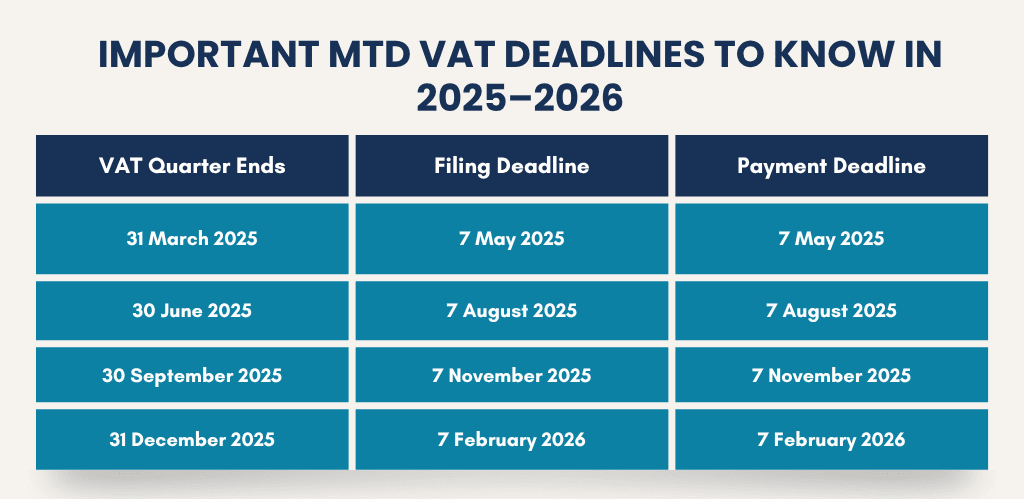

If you’re VAT-registered in the UK, you must file and pay VAT returns on time based on your accounting period. Most UK businesses follow a quarterly VAT cycle. Below are the standard quarterly deadlines for the 2025–2026 VAT year:

|

Tip: If you pay VAT by Direct Debit, make sure funds are available in your account at least 2–3 working days before the payment deadline. HMRC automatically collects payment shortly after the submission deadline. |

At Aone Outsourcing Solutions, we take the stress out of VAT and bookkeeping. Our team of UK VAT experts handles everything—from daily bookkeeping and VAT reconciliation to MTD-compliant VAT return submissions—so you don’t have to worry about missed deadlines or HMRC errors.

Whether you're a small business, accounting firm, or growing enterprise, Aone keeps your books clean, your VAT compliant, and your team focused on growth—not admin.

Ready to simplify VAT? Contact Aone for a free consultation.

The pressure of staying VAT-compliant under Making Tax Digital is real—and it’s not going away. If you’re still relying on spreadsheets, outdated software, or juggling VAT submissions between other priorities, you're putting your business at risk. The good news? Outsourcing VAT and bookkeeping isn’t just for big firms. It’s an affordable, efficient, and scalable way to manage compliance, reduce errors, and gain real financial clarity.

By working with an experienced provider like Aone Outsourcing Solutions, you get expert support that adapts to your business needs—whether you’re filing quarterly VAT returns, managing multi-entity reconciliations, or simply trying to stay on top of cash flow. It’s time to take the pressure off your shoulders, eliminate the guesswork, and let professionals keep your books clean and your VAT accurate—all while you focus on growing your business.

Yes, VAT return preparation can legally and effectively be outsourced in the UK. Many businesses use outsourcing firms or accounting providers to handle VAT reconciliation, MTD submissions, and compliance, ensuring returns are accurate and filed on time.

The main benefits include cost savings, fewer errors, better compliance with HMRC, access to expert support, and more time for your team to focus on core business tasks. It also helps ensure real-time recordkeeping and smoother MTD submissions.

Absolutely. Small businesses benefit greatly from outsourcing because it removes the cost of hiring in-house staff, training, and managing compliance tools. Many outsourced bookkeeping packages start from £100/month, making them a smart investment.

VAT reconciliation outsourcing involves hiring professionals to match your VAT-related transactions—like sales and purchases—to ensure all VAT amounts are accurate, complete, and correctly reported to HMRC. It reduces compliance risks and supports MTD.

Yes. Under HMRC's Making Tax Digital rules, all VAT-registered businesses with turnover above £90,000 must maintain digital records and submit VAT returns using MTD-compatible software like Xero, QuickBooks, or Sage.

If you miss a VAT submission or payment deadline, HMRC may apply penalties under the points-based penalty system. Late filings, even once, can trigger warning points that accumulate into fines and interest charges.